Cocoa futures continue the same story; will the demand outlook brighten? Will supply be low? Is the weather premium already accounted for? These are the constant questions that carried us through the 2018 trading year.

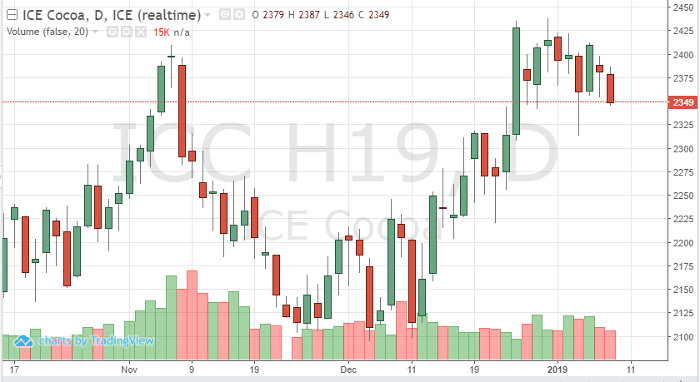

As we trade in the new year, the techincals appear to be taking the lead. Overbought levels have been reached, causing a slight pullback. The March contract has traded between 2350 and 2425 – 2400 is a key level. A close and hold above 2400 should help traders see new highs this year.

Although most fundamentals appear bearish, prices have stayed strong. Weather premium may have already been put into the market. That being said El Nino events have been fairly calm, main growing areas have seen mild weather – do we have some downside ahead due to these factors?

March ’19 Daily Chart