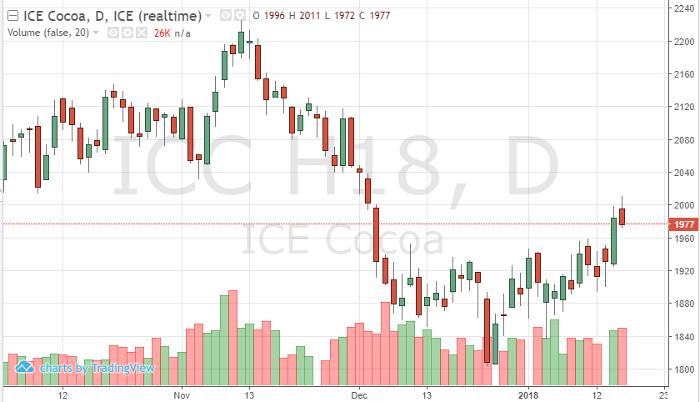

The anticipation and release of Asia grind data has led the cocoa trade this week. Strong data continues to help cocoa move higher. Strong demand is needed in order to give the March contract support. North American data surprised – coming in 1.28 percent lower compared to the same period last year. Expectations were between 1-3 percent. This data release sent cocoa lower in Friday’s morning trade – touching 1916 in the March futures contract. Heading into the release – Thursday’s high touched 2011 in the March contract but pulled back as traders awaited the grinding data.

The futures appear overbought technically but traders have been waiting for the first data release of the year to guide their trades. The recent surge and post-Brexit vote highs in the Pound should move cocoa prices higher as well.

After the dust settles from the grinding data, look for a technical trade to take over. 2050-2115 is a realistic range for this time of year if supply and demand levels can even out.

Cocoa Mar ’18 Daily Chart