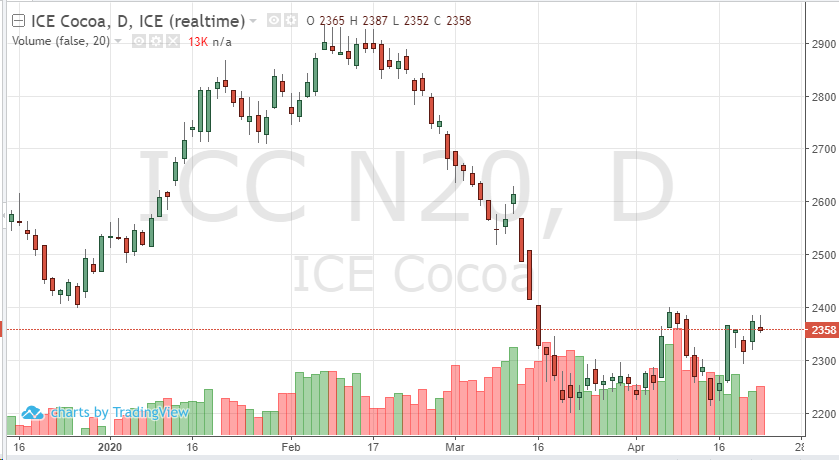

Cocoa futures have some fundamental news this week that normally would be strong enough to move the contract. European grinding data came in higher than estimates, causing Wednesday’s trade to see the July contract in the green. Traders were thinking the range would 2-4% lower but the European data came in up .9%. Asia data also came in above estimates, bullish for futures, but the market didn’t react that surprised. N. American data came in inline; all three of these should have had prices closer to 2400, instead the global uncertainty still has control of all markets.

Demand will remain weak in cocoa as most of the world remains in some form of a “lockdown” or restricted from the “norm.”

As the world continues to learn how to live in these times, commodities are trading off one main economic force, supply and demand. This seesaw is not giving the markets much to work with. Supply chains are obstructed, bullish prices, demand is lower, bearish prices – this equals rangebound trading sessions in cocoa most days.