December cocoa moved lower Wednesday for the second consecutive day due to the sell-off in equities. The overall world market tone has been vulnerable of late – this paired with a strong dollar has pressured the softs.

Demand in cocoa has been a big question mark this year, will we see a growth in the need for the commodity as we continue to trade in the final quarter of the year? There are no signs that demand is headed for an increase, so traders look to supply for some fundamental direction. The weather outlook in key growing regions, mainly Ivory Coast, appear to be bullish. Overly dry weather mixed with El Nino fronts could negativity impact production.

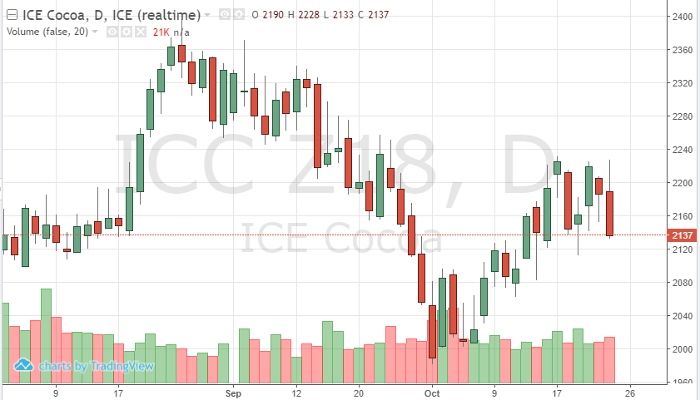

Technically, we have seen resistance at 2230 in cocoa futures, a break and hold above this level could have the market headed back to where it should be this time of year, closer to 2300. Look for a trading range of 2300-2400 as we head into the last stretch of 2018.

Cocoa Daily Chart