With a shortened week due to the US holiday, cocoa has been unable to decide its next move. Supply is still the front story, providing most of the support. Will weather be a factor, El Nino? Will disease hit pods due to weather related problems? Will political uncertainty in Ivory Coast add to output concerns? All of these questions could boost prices higher.

Demand has been and will continue to be the biggest question. Looking at the euro and pound has given us little guidance. The equity market has been volatile and has led to more global uncertainty. The July 9 COT report will give us a view of what traders are thinking as they continue to position themselves.

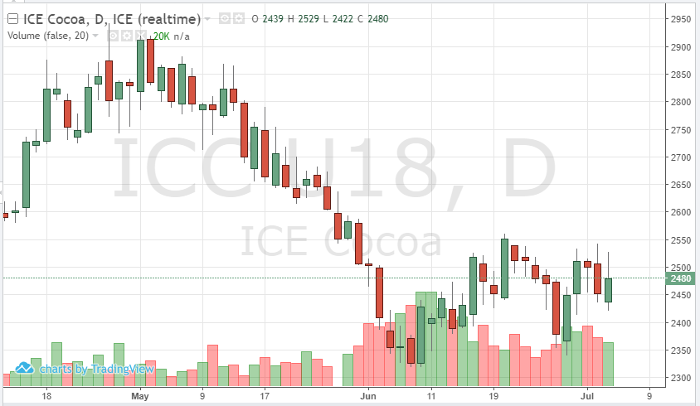

Cocoa Sep ’18 Daily Chart