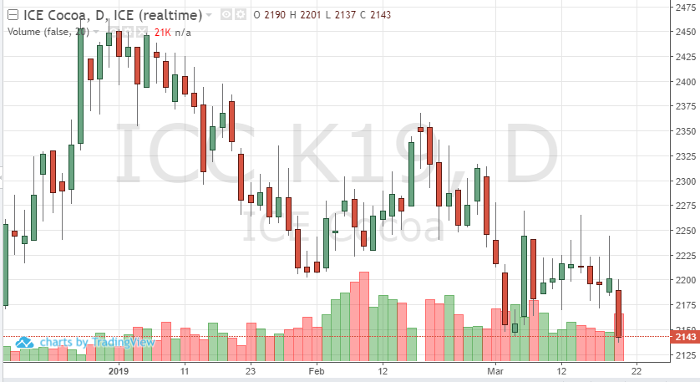

During Wednesday’s trading session, May cocoa attempted to break some key support levels. The contract ended up closing right above the 2140 level, trading below support, but closing 3 ticks above. With a close below the 9-day moving average (typically a bearish signal), traders may see a few more down days. With the high put in at 2201, prices attempted to break the key resistance level of 2200 but failed on the anticipation of stronger production data.

If the crop comes in bigger, look for prices to move lower unless global demand can grow stronger. A true supply reading out of West Africa won’t be available for weeks, but rumors will move the market in the meantime. Right now, the Asian demand should be able to provide some support for higher prices. Grinding data from that region looks to be moving higher against historical data. Demand from N. America and Europe continues to provide volatility and uncertainty. These areas continue to be wild cards.

With Prime Minister May’s request to have Brexit discussions pushed out to late June – currencies will continue to be key indicators for cocoa’s short-term outlook as well

Cocoa May ’19 Daily Chart