Political unrest in Ivory Coast has added volatility to an already erratic market…. but there is a lot going in cocoa futures. Cameroon reported that their arrivals are lower than last year, they were expected to be higher. Indonesia, the 3rd largest grinding nation of cocoa, reported that exports are ahead of last year’s pace. At the same time, Indonesia’s imports are 23% lower than last year, which adds to the demand issues in the Asian markets. Demand is a concern in the US too due to chocolate company’s anticipation of lower sales due to the “cancellation” of Halloween in many regions.

The Euro and Pound short-term reversals provided support to cocoa prices. Supply is also a concern in key cocoa areas, which is also providing strong support. The macro side of the global markets is also somewhat positive, for now, that is helping some commodities.

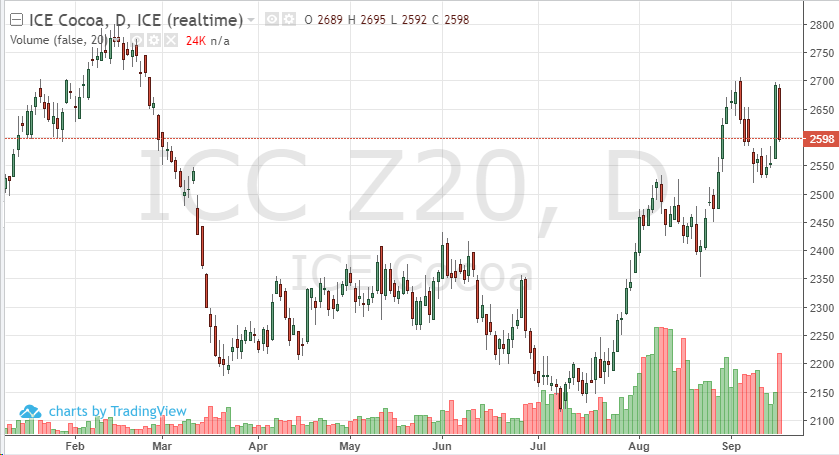

Expect the unexpected, as well as volatility, as we trade the next month before the U.S. election. Technically, 2700 is resistance in the December contract, a break and hold above this could have cocoa testing the high put in in February – but the holiday season demand and company earring reports will have control of this market for the remainder of the calendar year.