Cocoa futures have been weakened by demand and the global equity markets. As the U.S. and European markets moved higher for back to back sessions for the first time since February, cocoa tried to bounce off a potential bottom in the May contract. Global restrictions and stoppage of work in key regions for cocoa have added to the pressure the market has been feeling. An uncertainty of when certain restrictions will be lifted should cause volatility in the coming weeks. The safety and health of the world is the main concern of everyone and recovery in the markets will occur when limits are lifted at the proper time. For cocoa specifically, any disruption to cocoa operations and exports will affect prices in the short-term. As with all commodities, the supply chain is key right now.

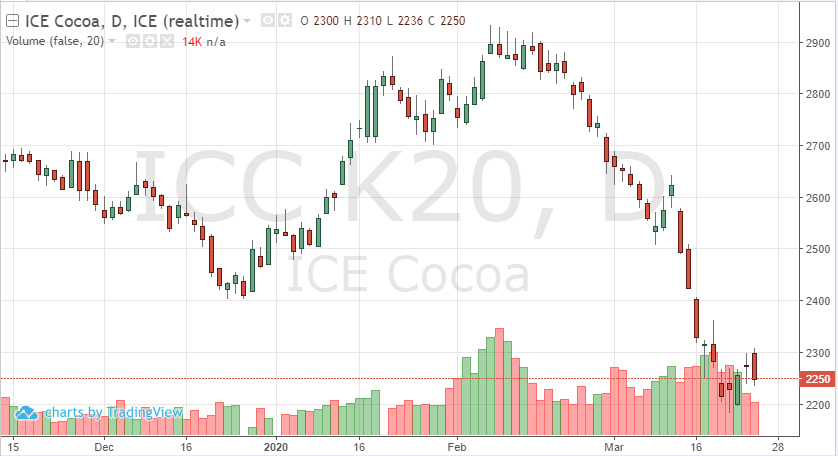

From a technical standpoint, 2300 is resistance, while 2250 is short-term support. Prices that we saw at the end of February should be back once the coronavirus is under control and numbers plateau but in the meantime, the soft markets are weak and vulnerable.