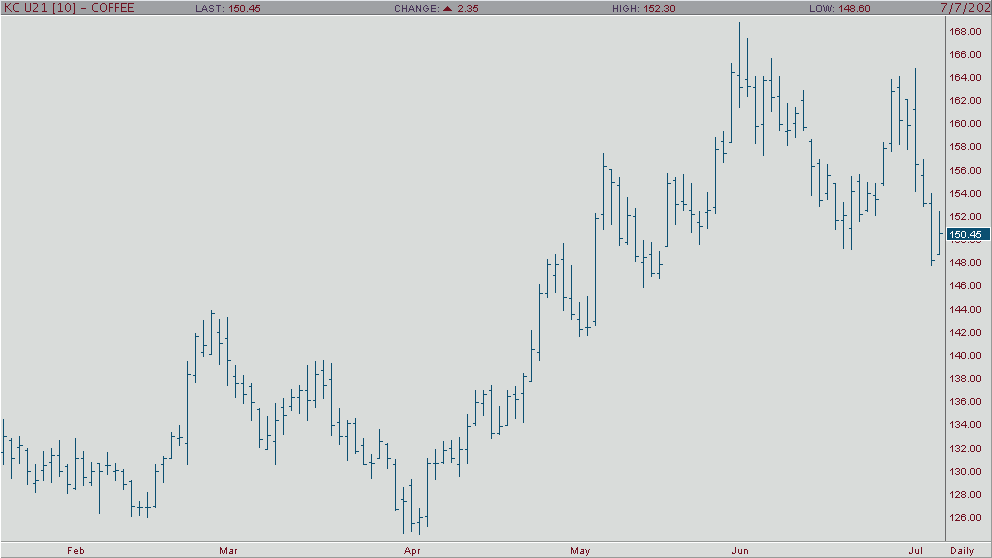

Coffee prices have fallen more than 10% from last weeks highs, as the market has seen an abrupt change in tone since the start of the month. While it may still have a bullish supply/demand setup for the longer term, it could remain on the defensive this week if the risk off mood persists. September coffee had another range down move on Tuesday and fell to its lowest levels since May. A pullback in the Brazilian currency to a new 5 week low, added to the woes as that could encourage Brazilian growers to aggressively market their product overseas.

The market is back below the 60-day moving average and suggests the longer-term trend could be turning down. The markets close below the 9-day moving average is an indication the shorter term trend remains negative. Resistance comes in at 15125 and 15565 while support is at 14510 and 14325.