While December coffee futures continue to garner support from all-time highs in the U.S. stock market and steady demand, the futures are beginning to reach overbought levels and traders should use caution at this point. Ongoing supply issues in Central America and Columbia have added good support under December coffee prices. Our friends at the Hightower Group have reported that “while it is possible that large quantities of Brazilian Arabica will be certified deliverable, it is unlikely to occur which will keep those stock levels near multi-decade lows. In addition, supply issues with Columbia and Central American producers should help to keep coffee prices fairly well supported.”

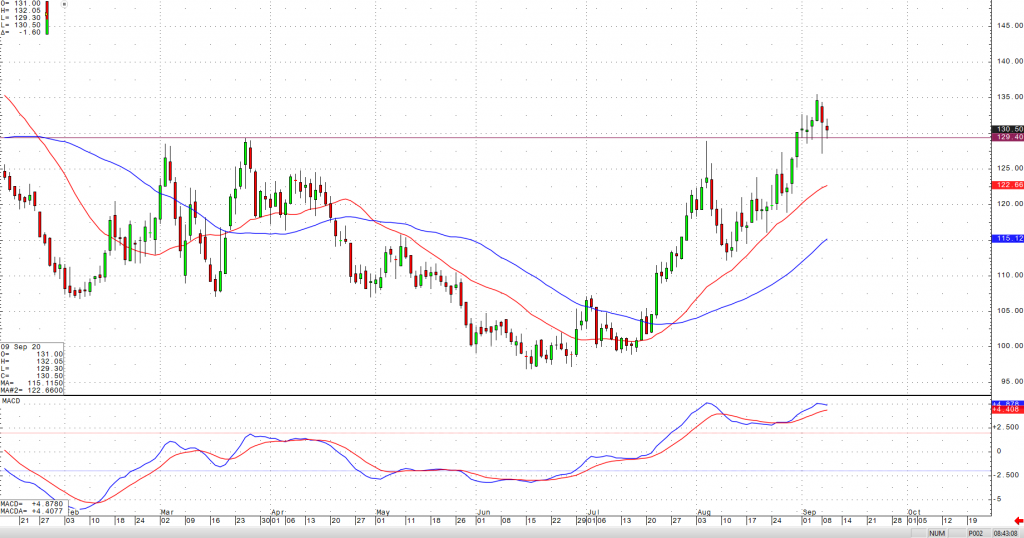

As we continue to struggle with revenues of restaurants and coffee shops being weighed down severely by limited occupancy, more and more of these cherished businesses will continue to vanish permanently. In addition, the likelihood that many small businesses will be in a hurry to return to urban areas where riots have taken place just adds more pressure and uncertainty to an already grim outlook. From a technical perspective, a recent break above the 129 level, followed by a sizeable corrective pullback, should be viewed as bullish. Resistance should be found at the 135 level and support at 120.