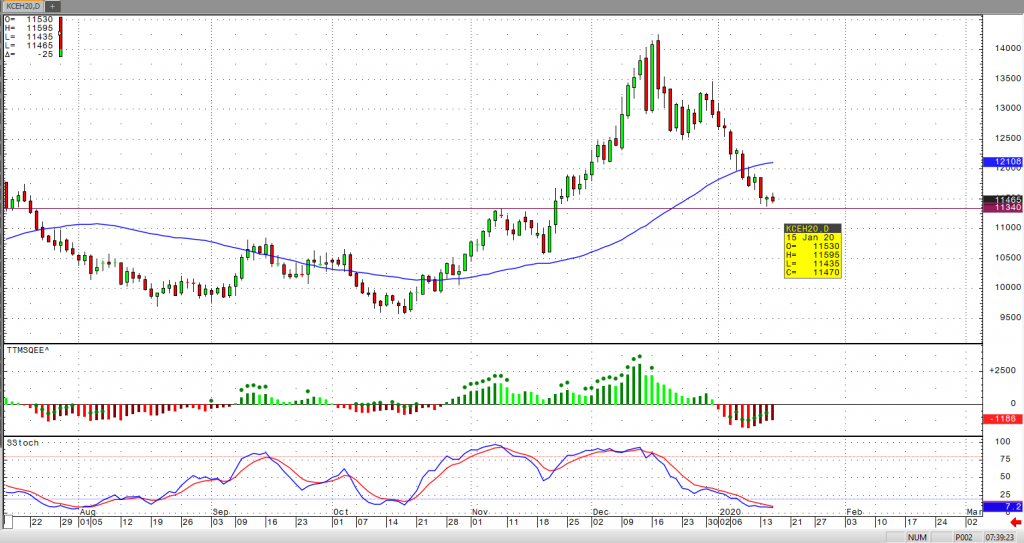

In my last article, I made mention that long liquidation was taking place, and we should begin to see some support being offered at the 113 level in March coffee prices. The fact still remains that tightening supplies are still on the horizon, which initially sparked this most recent, strong bull run over the past month. At the same time, we continue to make new highs in U.S. stocks, which should equate to steady demand for coffee. I am still very much bullish due to the fundamentals of March coffee.

Our friends at The Hightower Group shared that “coffee has a chance of seeing upside follow-through buying during today’s price action.” From a technical perspective, we have violated the 50-day moving average, and the 113 level is critical for holding support.