Slowly but surely businesses and schools are re-opening which has presented the bulls with opportunities to step in and find support in March coffee futures. Although the vaccine distribution efforts have been a bit slow-going, the fact that there is a vaccine continues to build confidence in the mind of the worker and consumer. However, “a new study from the National Restaurant Association claims nearly 17% of U.S. restaurants have closed either permanently or long-term amid the coronavirus pandemic.” These closures may likely affect the mindset of the entrepreneur, and ultimately the demand for coffee. For the next couple of years, or at the very least, until the pandemic is completely in the rear-view mirror, we should expect demand to remain stable but in check.

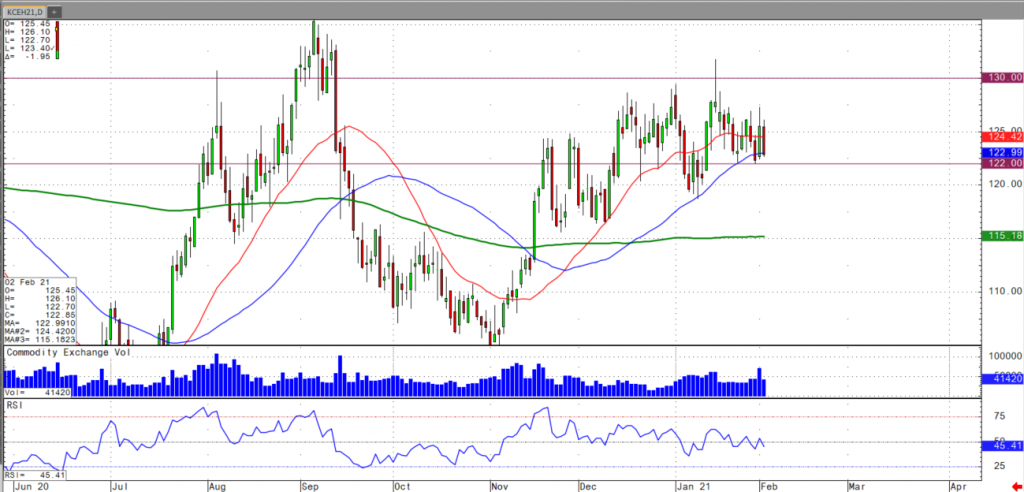

Sideways consolidation has been the technical news for March coffee prices, with price action tied to a well-defined range of 120-129. Currently March coffee futures are hugging the 50-day moving average, resting at 122. Traders should monitor for a break above the 130 level for upside continuation, and break below the 120 area (and ultimate violation of the 50-day MA) should spell a reversal down to the 200-day MA (resting at 115).

For more frequent commentary, please check out and subscribe to my daily futures market videos on coffee and other commodities.