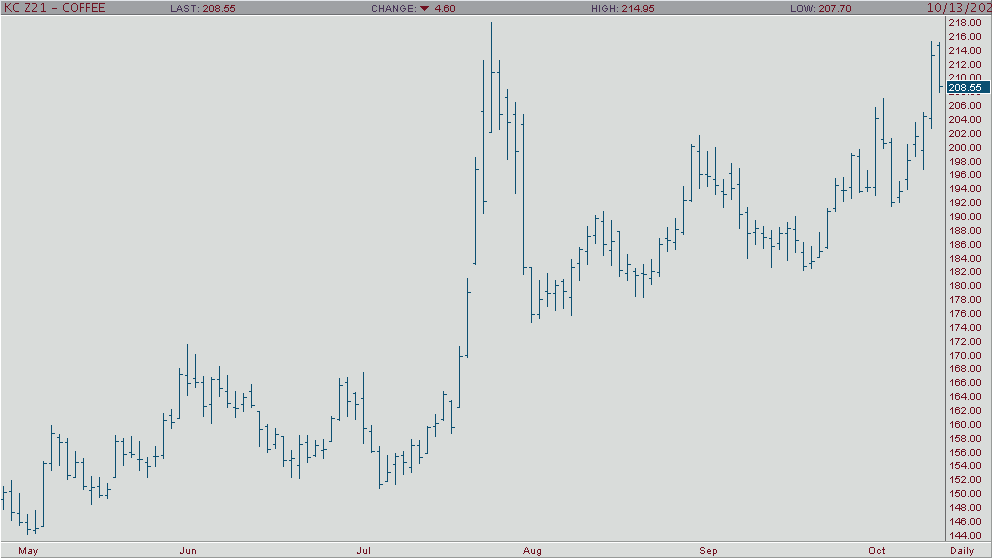

Coffee prices have jumped more than 10% over the span of one week, as supply-side developments both near and longer term have fueled this rally. Although the coffee market is beginning to reach overbought levels, it looks to have much more upside left to go before this rally runs out of steam. Brazil could see crops negatively impacted by extensive drought conditions and frosts during July. Reports that farmers may default on over one million bags in deliveries have also ramped up near term supply anxiety. These supply issues are exacerbated by the global shipping container shortage that continues to fuel coffee’s longer-term uptrend. Rising overbought levels warrant some caution for bullish traders. A positive signal for trend short-term was given on a close over the 9-bar moving average. There could be more upside follow through. Resistance comes in at 21940 and 22355. Support comes in at 20685 and 19845.