May coffee continues to struggle with weak demand due to the ongoing slow-but-sure reopening of the economy. Although the long-term outlook from the worlds largest producer is still quite bullish, the near term continues to dance along support levels that have been in place since December of last year. In addition, a continued weak Brazilian currency promises to hold May coffee prices in check until demand begins to pick up.

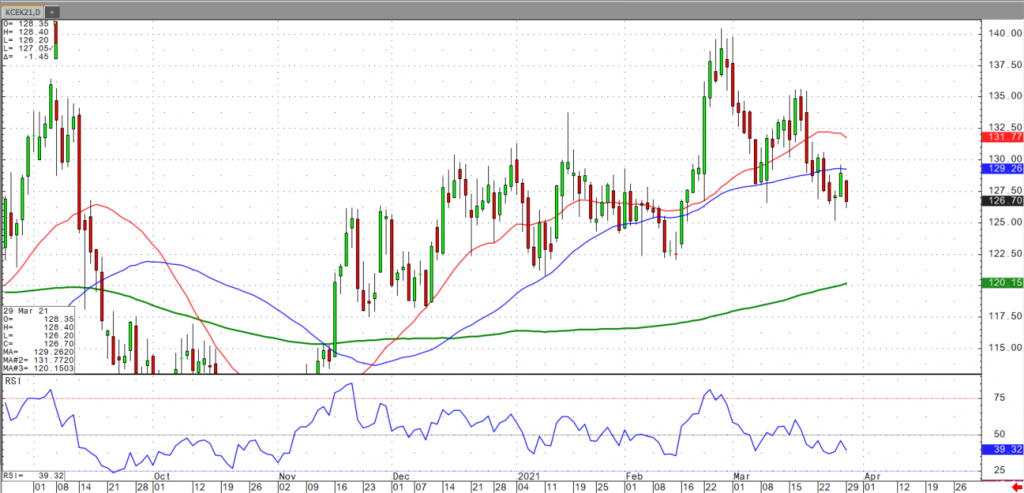

From a technical perspective, May coffee has violated both the 25 and 50-day moving averages. However, May coffee prices have been comfortable in this range from 1.22 to 1.30 since December of last year. Although RSI levels are not yet oversold, we may see a continuation in the intermediate selloff back to the 1.22 level if positive demand news is not found soon.

For more frequent commentary, please check out and subscribe to my daily futures market videos on coffee and other commodities.