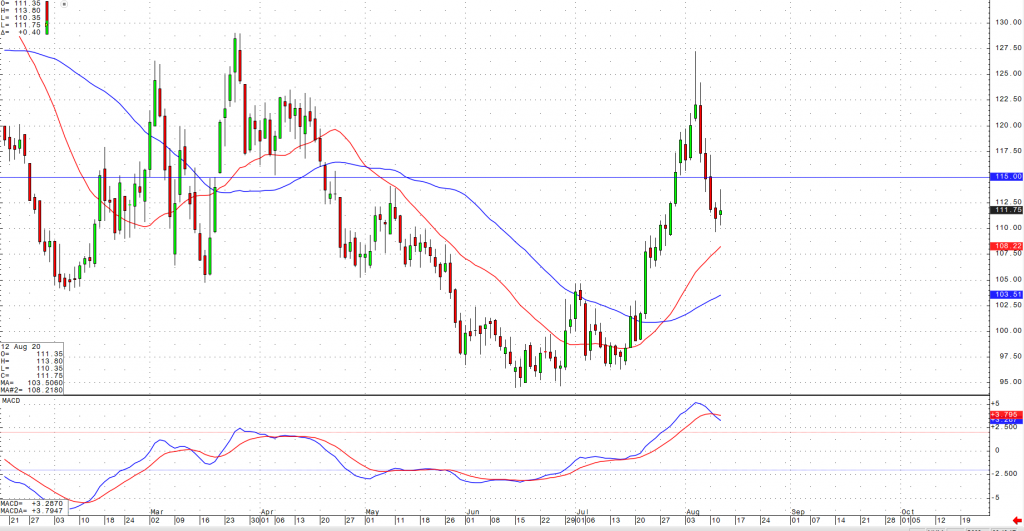

A recent with “risk-off” mentality across the markets forced some long liquidation of various commodities, including the price of September coffee. While coffee has experienced a volatile and significant pullback to lows not seen since mid-May of this year, many traders believe that with a continued weakening US Dollar and strength in the US equities market, we should soon see September coffee prices hold support around the 110 area.

While several States are still struggling with increased COVID-19 cases (due to increased testing capabilities), traders should remain extremely cautious that until our world is fully operational and back to normal, coffee prices will continue to suffer volatile swings and major moves. I’ll say it again, until that day when restaurants are permitted to increase their level of capacity (or even remain open), home coffee sales will not be nearly enough to offset the gaping void of demand left unfilled by restaurants and coffee shops. In addition, many of these restaurants and coffee shops may never return. From a technical perspective, we await a retest of the 120 level should take place over the next week and a close above 127 will be required in order to negate this most recent downturn.