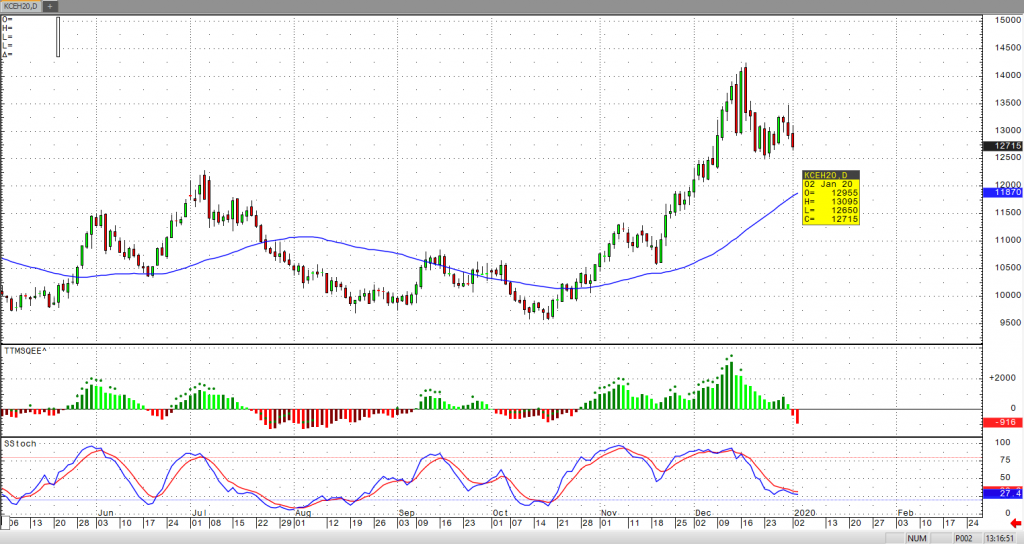

Tightening supplies have sparked a strong bull ran in March coffee prices over the past month, but we are likely to see a temporary selloff back down to the 122 level in the very near term. I am still very much bullish due to the fundamentals of March coffee, but such strong buying over a short period of time is likely to be met by profit taking and new longs may step aside for the time being. Our friends at The Hightower Group shared that “In spite of the year-ending pullback, coffee prices climbed more than 25% value during 2019 and rallied more than 50% above their 14-year lows posted last April.” This is significant for a market that has been in a major bear trend for such long period of time. We have broken above the 142245 high from October of 2018 and we will likely continue in this direction, after this pullback has taken place.

From a technical perspective, we have cleared several resistance areas, including 14225, but in the near term we should see some continued long liquidation, and the 122 level is critical for holding support. With momentum and volume at high levels, the bull camp should take a breath and re-join once the 122 level has been reached.