December coffee prices have taken and incredible hit over the last couple of weeks as on year production forecast for Brazilian coffee is near-record high levels. This overwhelming bearish-supply side news is surfacing during ongoing confusion and volatility, relating to re-emerging COVID 19 shutdowns in the UK. The issue continues to be the lack of secure demand to meet this supply, which is currently pricing in a glut.

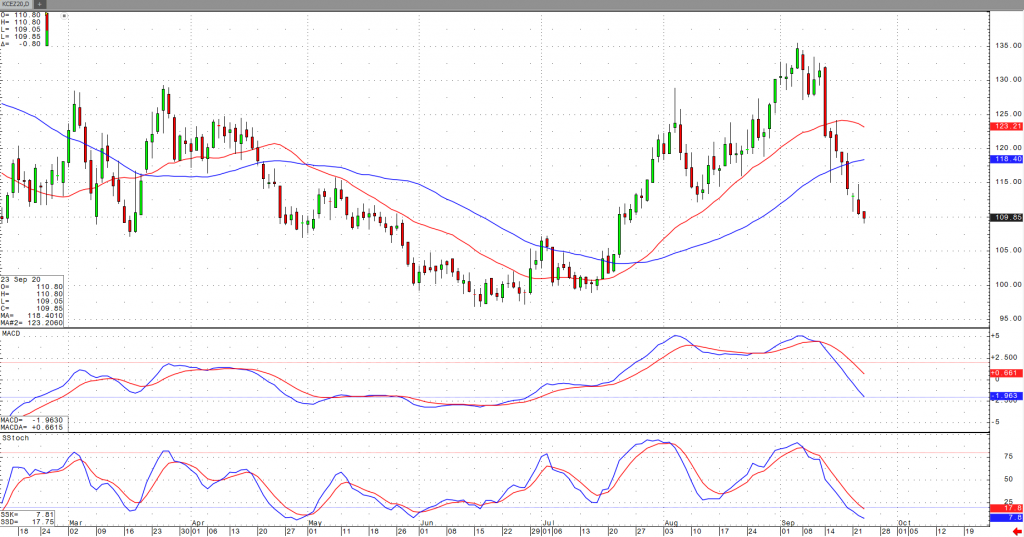

The U.S. dollar continues to garner strength, with many traders noting a clear upside breakout above resistance levels, and as a result, most all commodities have experienced a strong selloff. As we continue to struggle with revenues of restaurants, bars and coffee shops being weighed down severely by limited occupancy, more and more of these types of businesses are filing for bankruptcy and will never return. This is lack of demand that will leave an enormous void in the marketplace. From a technical perspective, a recent dive below the 50-day MA at the 118 level, should be viewed as continued bearish, but such an aggressive selloff should result in a subsequent correction back to the 118 level. Until more demand news surfaces, I would expect a continued selloff at this time.