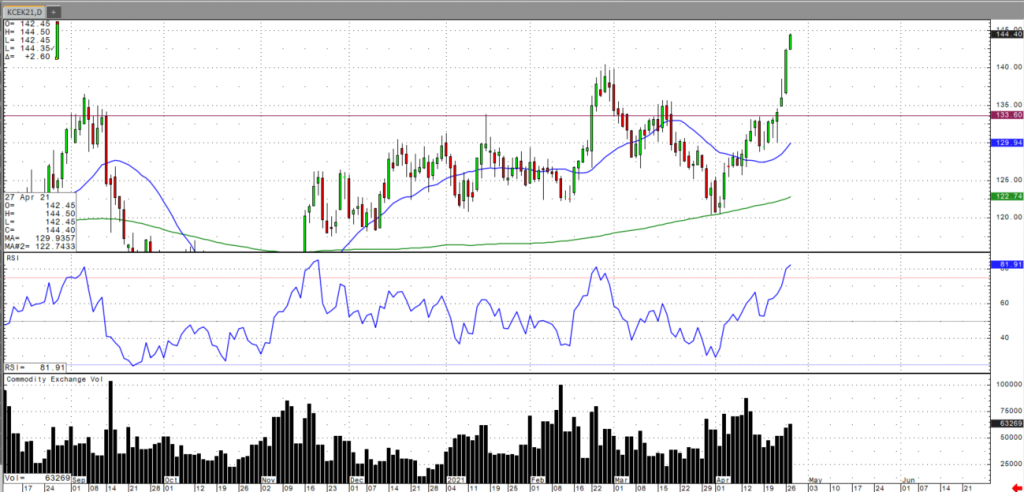

Dry weather in Brazil has precipitated this aggressive rally, allowing May coffee futures prices to easily clear the 50-day moving average, with the 1.50 level on the horizon. Tight supply outlook, coupled with increasing demand have prompted the May coffee futures prices to break above the February 140 highs, but RSI levels are in extremely overbought territories at this point.

In my last article, I stated that “May coffee has is beginning a reversal up H&S pattern with a break above the pattern’s 1.30 neckline. If this pattern follows through to completion, it carries a measuring objective to 1.39.” This head and shoulder reversal pattern was successfully completed and May coffee now holds support above the last rally high of 1.4045 from February 25th. May coffee will likely retrace back to the 1.40 level before consolidating, which will then determine whether a reversal, or another leg higher will take place.

For more frequent commentary, please check out and subscribe to my daily futures market videos on coffee and other commodities.