Extreme consolidation seems to be the story at this point in May coffee prices. For the last few trading sessions, May coffee (along with several other commodities) continues to fall short of garnering the much needed fresh “risk-on” traders need to sustain support prices. However, our friends at The Hightower Group have stated that “coffee continues to show more signs that a longer-term low may be in.”

In the wake of the coronavirus, commodities will continue to flounder, and stocks will feel added pressure until the virus is stabilized. This has had a major impact on dampening the ascension of markets that would otherwise fundamentally (and seasonally) be trading higher. Before May coffee can find solid support, traders are in dire need of good news regarding China’s ability to stabilize the coronavirus so that more risk capital can make its way to various commodity markets (including coffee). While U.S. stocks continue to tumble, longs will need to lay low and wait.

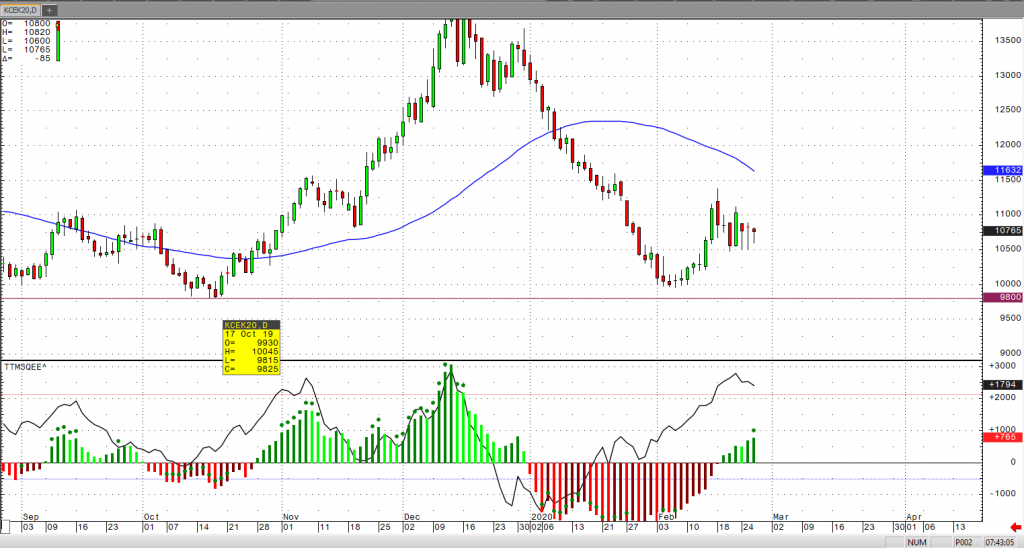

From a technical perspective, we have been able to hold support at the 9800 critical low from October of last year, with a subsequent strong bounce to the 11380 level. This price action should be viewed as a potential bottom in May coffee, but with the continued uncertainty related to the coronavirus, we should expect more sideways price action.