With continued unrest in the US Elections, added volatility has struck most all commodity prices, including that of December coffee. While December coffee prices continue to trade mostly sideways, during continued increases in Covid 19 cases, it seems clear that December coffee prices have not received the required fundamental news need it to turn the market to the upside.

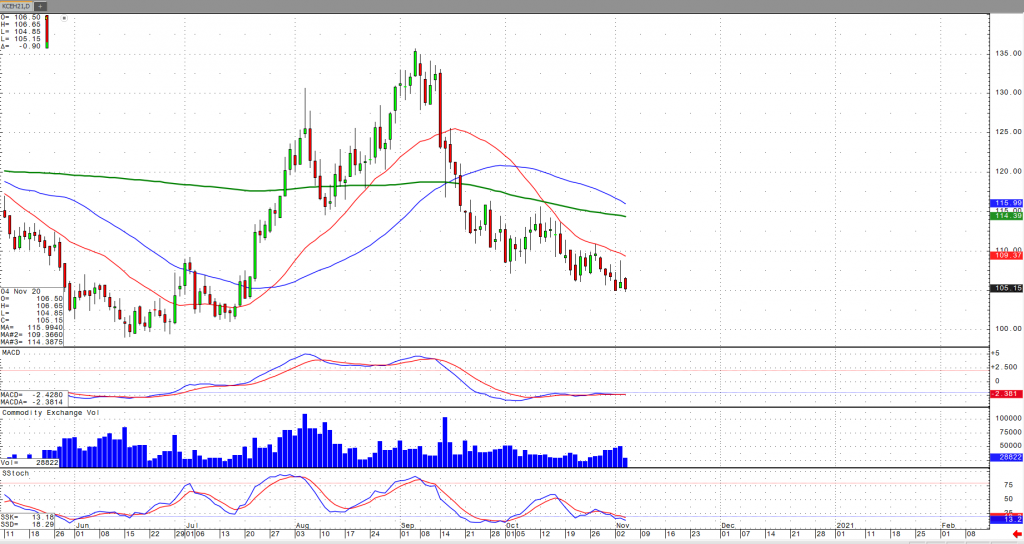

With the realistic potential of a new administration looming, the threat of potential new lockdown measures throughout the US has added some pressure to commodity prices. Although we’ve seen the US stock market has rally over the past 24 hours, likely due to a new administrations potential easing tariff measures against China, more bullish news in the way of coffee demand will be needed to lift coffee prices higher. From a technical perspective, December coffee prices continue to trade well below the 200-day MA (now resting at around the 114 level) which is continued neutral to bearish, and likely will see follow through selling to the key support area of 100.