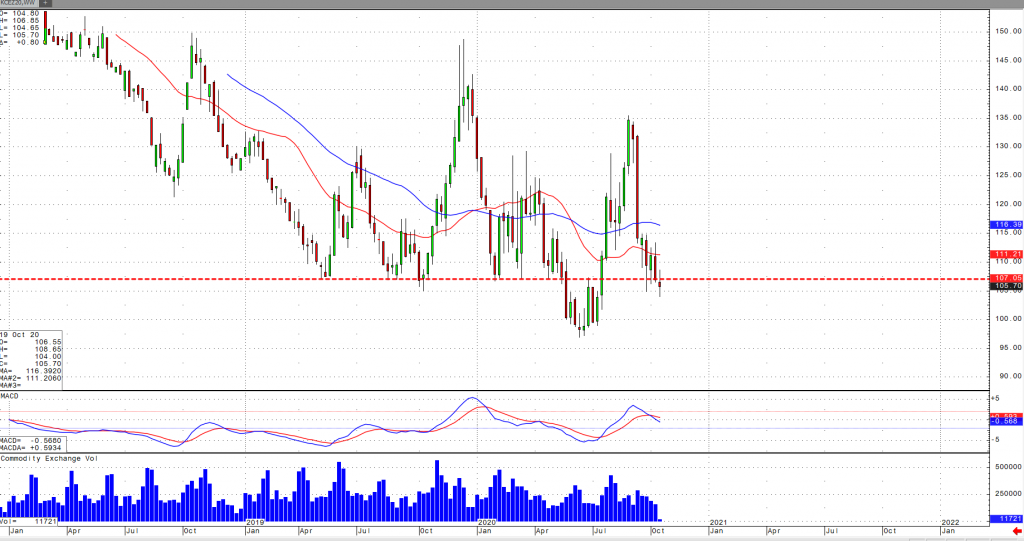

December coffee continues to visit levels that have not been seen since Jun-July of this year, when new Covid-19 cases began to spike to the highest global levels. New lockdown measures through Europe have not helped the demand fundamentals of coffee, and with the US equities markets on a seemingly perpetual “teeter-tottering” basis, we can expect more of the same. Ultra-volatile market swings in commodities due to what has become less of a measure to help Americans with a much-needed stimulus package, but rather a pre-Halloween Horror Story of politicized measures by both Red and Blue parties to jockey for first position in bragging rights related to championing the cause of “The People”. The back and forth negotiations (and non-negotiations) which have dragged on for far too long have taken their toll on this economy from a demand perspective not only for coffee, but several other commodities that hang in the balance. From a technical perspective, December coffee prices have become very comfortable trading well below the 200-day MA (now resting at around the 112 level) is bearish, and likely will see follow through selling to the key support area of 100. We also can also make notice a consolidated bear pennant which if fulfilled (as a continuation pattern), could push December coffee prices to at or about the 100 level. I would expect a continued selloff at this time.