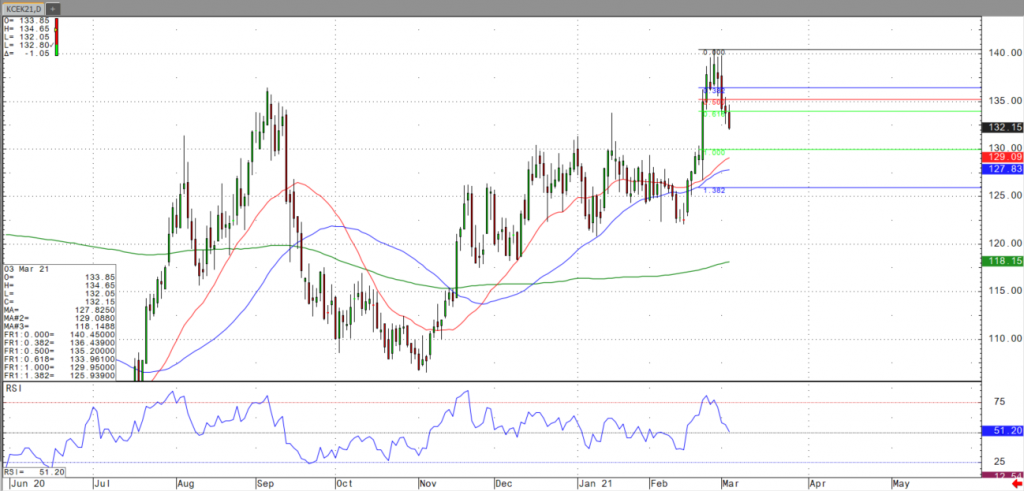

May coffee has retreated from the 1.40 highs aggressively over the past four trading sessions, due largely in part to a weak Brazilian currency and wet weather in key growing areas of the largest producing country, Brazil. Although the promise of much stronger demand is in play, this near-term weakness has May coffee prices potentially revisiting the well-defined range that had been in place from November 2020 through early this month. This recent selloff is also likely to be some long liquidation taking place as prices have not reached the 1.40 resistance level since December of 2019.

The recent breakout rally from February 22nd has been answered by an over 62% retracement correction. The high from the last major consolidation range is 1.30, so it is likely that this area should have some good support. With May coffee last trading 1.32, a continued selloff to 1.30 is still likely in the near-term.

For more frequent commentary, please check out and subscribe to my daily futures market videos on coffee and other commodities.