The recent rally sparked by a strong US and European stock market has lent some solid support to the September coffee futures. As we continue to struggle with our restaurants and coffee shops being handcuffed to limited revenues by way of limited occupancy, more and more of these cherished businesses will continue to vanish permanently. This sad reality is eminent and although the stock markets have shown signs of optimism, we can expect it will take quite some time to return these businesses back to pre-Covid 19 conditions.

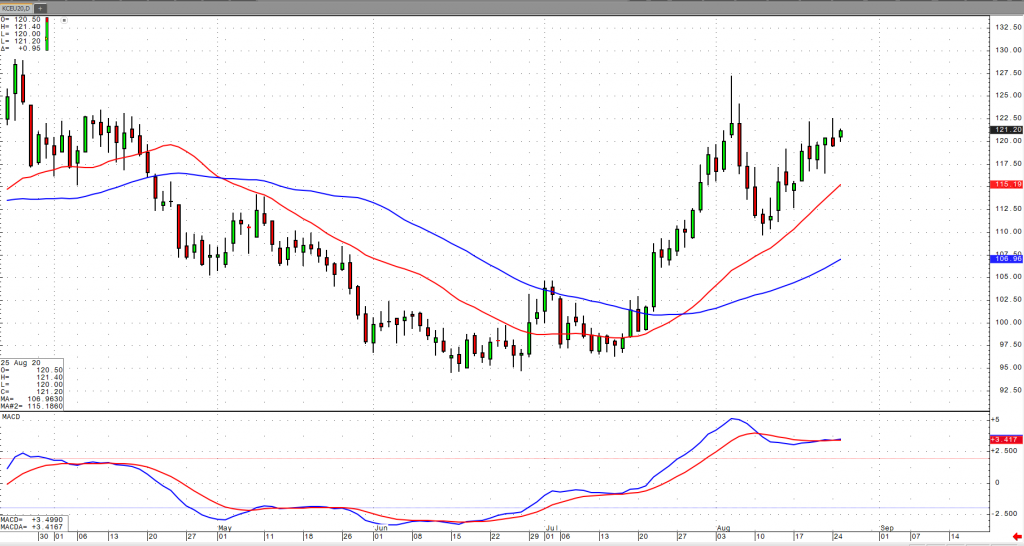

While several States are still struggling with keeping business open, many believe the only way forward will be to actually “move forward” and reopen these restaurants. Traders should continue to remain cautious while speculating, as we await more treatments and ultimately a vaccine that will slowly allow our population to move back to normal. Until that day, expect that coffee prices will continue to suffer volatile swings and major moves. I’ll say it again, until that day when restaurants are permitted to increase their level of capacity (or even remain open), home coffee sales will not be nearly enough to offset the gaping void of demand left unfilled by restaurants and coffee shops. From a technical perspective, a retest of the 122 level should take place over the next week and this upward move will put September coffee prices smack-dab in the middle of a well-defined trading range last seen in April.