Next week’s weather forecast for major growing areas in Brazil are showing quite favorable, which really helps to keep rallying December coffee prices in check. The recent strength in December coffee can be primarily attributed to dry conditions last year, and as our friends at The Hightower Group previously reported, “while next week’s rainfall should benefit Brazil’s upcoming 2020/21 production, it will not offset several months of dry conditions and July’s frost event”.

Recently, among ongoing tariff talks and new issues arising with Iran and the Saudi oil fields, we’re seeing more of a “risk-off” trade, with money camping out more on the sidelines of some safe-haven commodities and the U.S. dollar.

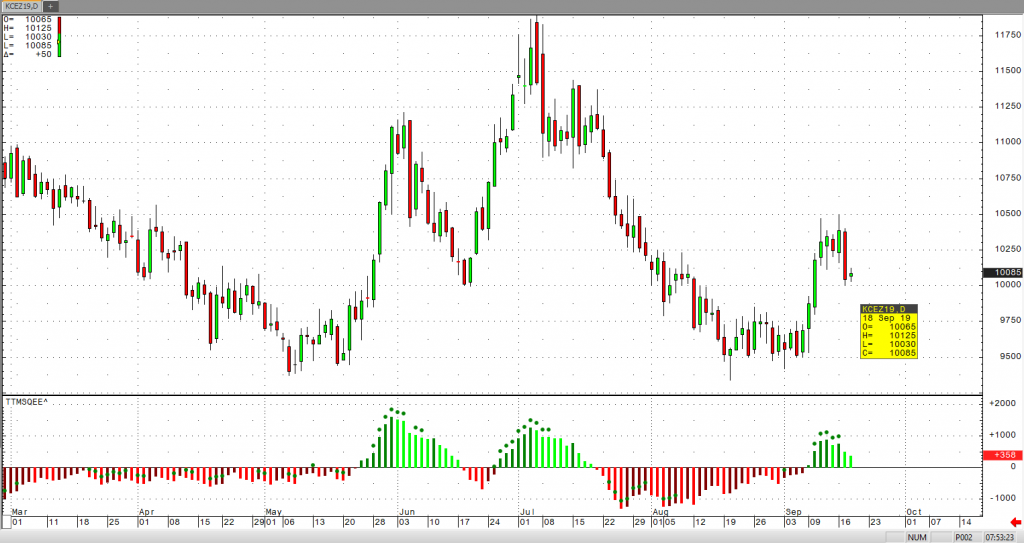

The December coffee price action yesterday showed some strong short-covering, but I believe that December coffee prices will need to see positive news in the way of resolved issues with Iran, and a weaker USD to offer the support needed to recover and revisit the 10750 level.