With U.S. stocks still trading at historic highs, a risk-on mentality has taken hold of the already bullish December coffee futures market. We continue to see that fundamentals such as a strong Brazilian currency over the past month, coupled with an ongoing poor weather outlook from key growing areas of Brazil have sparked some solid buying support to December coffee prices. Our friends at The Hightower Group have commented that “Vietnam’s Department of Customers said that their nation’s October coffee exports came in at 87,497 tonnes (1.485 million bags) which was down 5.3% from September and below government estimate of 100,000 tonnes (1.67 million bags).”

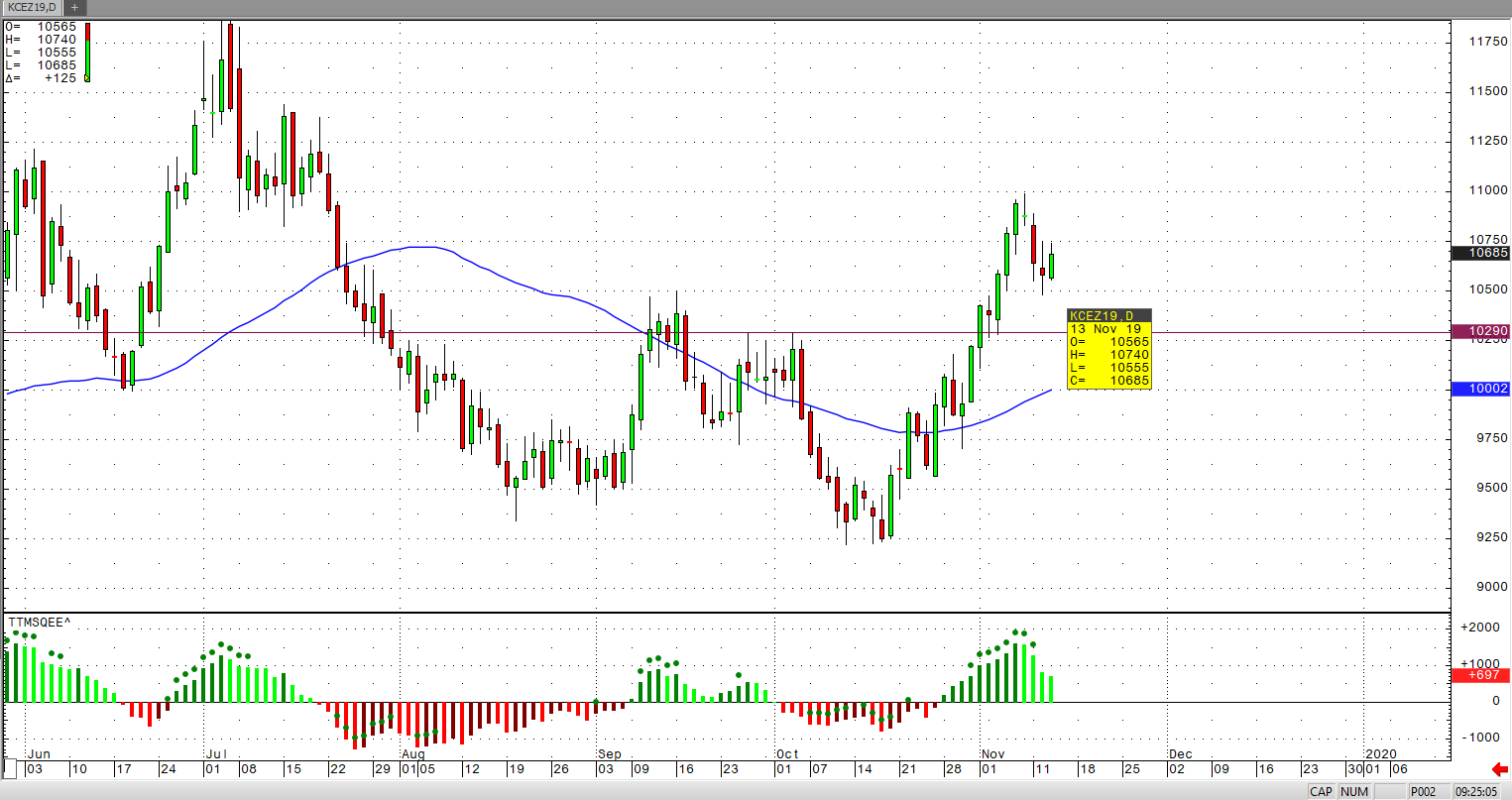

On the technical side, an impressive rally with a subsequent expected pullback shows all the signs of higher prices for December coffee in the long term. A break above the critical 103 resistance level was impressive, and as a result, sparked aggressive buying over the last week. We are likely to continue in an uptrend after this pullback. It may be a great time for bulls to jump in again once the pullback reaches 103 support again.