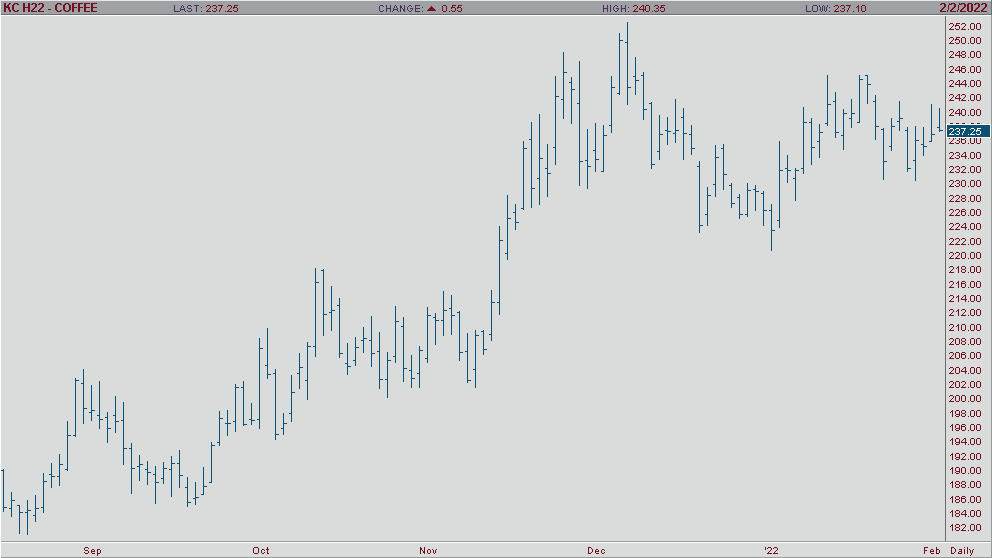

Coffee prices have seen coiling action over the past few weeks that has kept the market well clear of its early January low. With tightening near term supply, the trend could turn higher at any time. The Brazilian currency extended its 2022 rally to a new 4 momth high, which provided coffee with a carryover support as it eases pressure on Brazils farmers to market their remaining supply. In addition, the more that 42% drawdown in ICE exchange coffee stocks since the end of Sep. has provided significant support to the market as that reflects tightening near term supply in major consuming nations.

The crossover and close above the 40 day MA is an indication the longer term trend has turned to the upside. That being said, the shorter term trend on the 9 and 18 day MA has indicated a possible downtrend. Resistance comes in at 23920 and 24255, while support hits at 23420 and 23235.