The second week of June finished with a strong correction across the major indices and the YM experiencing another record-breaking drop. However, by Friday, the markets had calmed and even produced potentially bullish technical signals. The US Dollar Index did indeed head lower but subsequently retraced up towards 98.00, closing just shy of 97.00 by close of business Friday, and it may still intend to continue up to 98.00 this week.

The protests against police are continuing, not just in the US, but globally. It appears that only genuine reforms – already being proposed in some states and in the Senate – might quell the general angst related to policing policies.

Meanwhile, US infections and deaths related to COVID-19 have spiked at the time of writing. This is believed by many commentators to be related to premature re-openings in several states, and the recently declining trend has now reversed and shows a return to even greater infection rates, now at 2.12 million and 117,000 deaths, respectively.

This week, key economic calendar news events to watch out for this week may be:

- Core Retail Sales – Tuesday.

- Crude Oil inventories – Wednesday.

- Initial Jobless Claims – Thursday.

The indices continue to show increased volatility, with mixed bullish and bearish price action. It would be prudent to continue to apply rigid risk management on any trades this week.

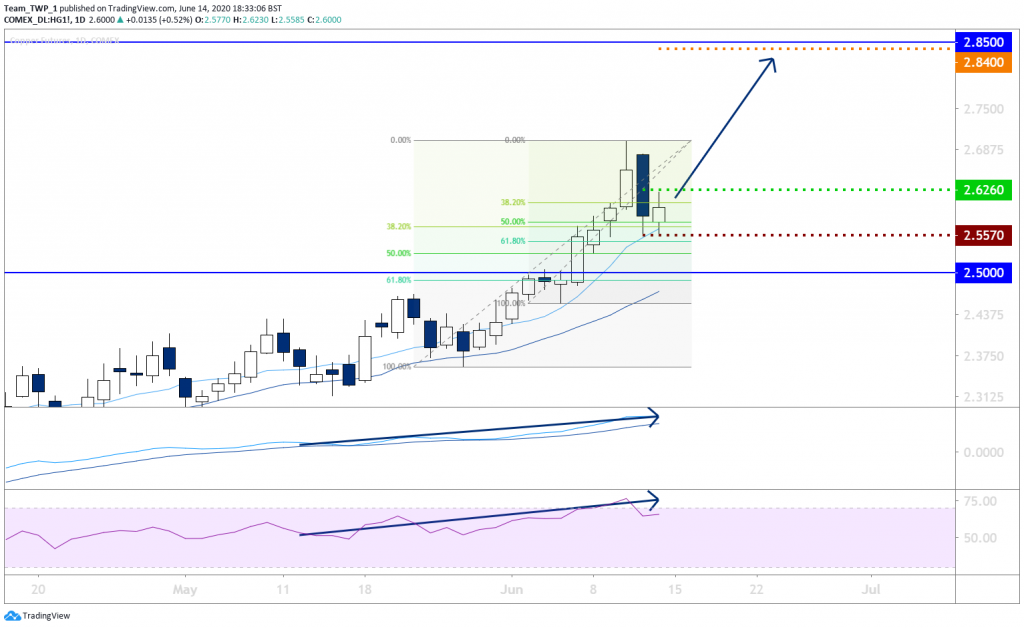

Copper, Daily, Bullish

The weekly now shows a clear uptrend and price has broken above significant levels at 2.6340. Both momentum indicators are trending higher, supporting a bullish sentiment.

The daily chart is trending and has produced clear higher-lows and higher-highs and broken recent resistance at 2.5000.

Price also sits on two separate Fibonacci levels, clustering at 50 percent and 38.2 percent respectively as possible support.

Price has now retraced back down to the moving averages (MAs) and created a bullish potential swing-low candlestick.

An entry above the high of this candlestick around 2.6260 may provide an entry into the next leg up if the trend resumes.

A stop-loss below the low of the candlestick around 2.5570 may provide a fair reward-to-risk outcome. Placing the stop-loss below 2.5000 may add increased technical protection at a loss to reward-to-risk ratio.

There may be major resistance around 2.8500, in which case it could be prudent to exit the trade around 2.8400.

Should price during the next session break the low of the candlestick before breaking the high, the trade becomes invalidated.

Again, traders may consider taking partial profits at a 1:1 target to mitigate risk. Risk management will be key, so a stop-loss is imperative, in order to protect capital exposure against unforeseen outcomes.

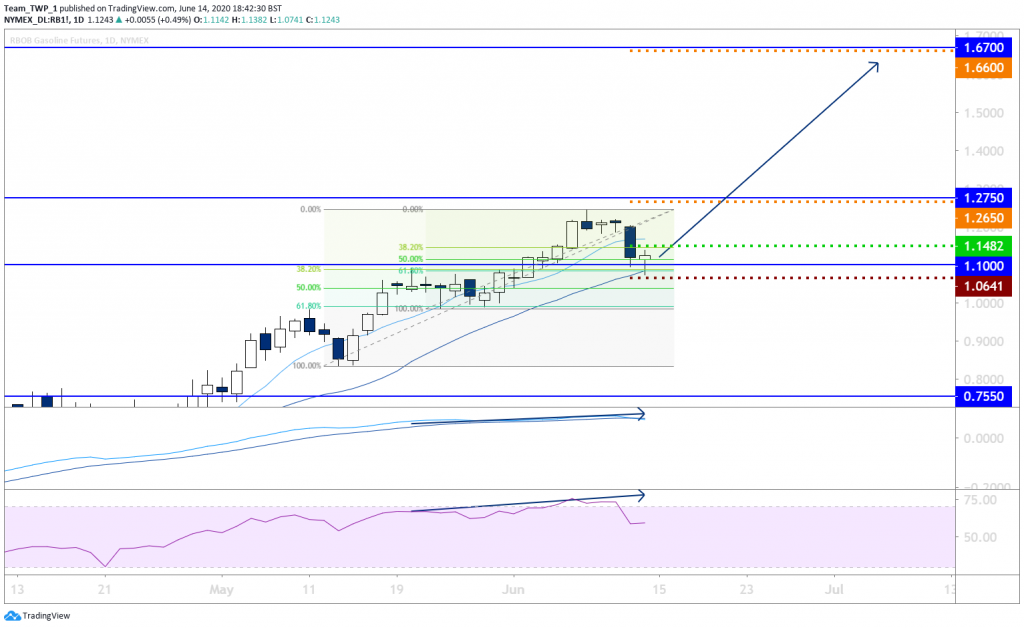

RBOB Gasoline, Daily, Bullish

As with Copper’s price action behavior in the trade possibility above, weekly RBOB Gasoline shows a clear uptrend.

Both momentum indicators are trending higher, supporting a bullish sentiment.

The daily chart is trending and has produced clear higher-lows and higher-highs and broken recent resistance at 1.1000.

Price here also sits on two separate Fibonacci level clustering at 61.8 percent and 38.2 percent respectively as possible support.

Price has now retraced back down to the MAs and created a bullish potential swing-low candlestick.

An entry above the high of this candlestick around 1.1482 may provide an entry into the next leg up if the trend resumes.

A stop-loss below the low of the candlestick around 1.0641 may provide a fair reward-to-risk outcome. Technical protection could be increased by placing the stop-loss below 1.1000.

There may be major resistance around 1.2750, and again at 1.6700, in which case exiting the trade could be considered prudent around 1.6600.

Should price during the next session break the low of the candlestick before breaking the high, the trade becomes invalidated.

Again, traders may consider taking partial profits at a 1:1 target to mitigate risk, especially as 1.2750 may impact price negatively. Risk management will be key, so a stop-loss is imperative, in order to protect capital exposure against unforeseen outcomes.