Posted on May 12, 2022, 11:34 by Dave Toth

DEC CORN

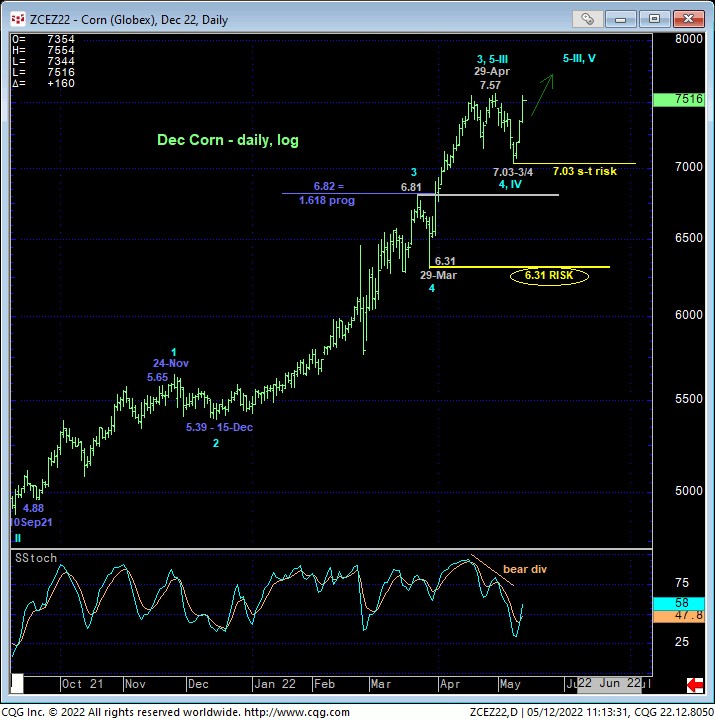

Today’s recovery above last Thur’s 7.39 minor corrective high renders the sell-off attempt from 29-Apr’s 7.57 high to Mon’s 7.03-3/4 low a 3-wave affair as labeled in the hourly chart below. Left unaltered by a relapse below 7.03-3/4, this 3-wave setback is considered another corrective/consolidative structure that warns of a resumption of the secular bull trend that preceded it to new highs above 7.57. Per such, shorter-term traders with tighter risk profiles whipsawed out of bullish exposure following 06-May’s bearish divergence in short-term momentum are advised to return to a resumed bullish policy and exposure with a failure below 7.03 required to negate this call and warrant its cover. The Fibonacci fact that early-May’s sell-off attempt held the minimum 38.2% retrace of Mar-Apr’s 6.31 – 7.57 rally would seem to reinforce this resumed bullish count.

On a broader scale and against the backdrop of the secular bull trend shown in the daily (above) and weekly (below) log scale charts, it’s easy to see the mere corrective nature of this month’s latest sell-off attempt. On such a broader scale, commensurately larger-degree weakness below 29-Mar’s 6.31 larger-degree corrective low and key long-term risk parameter remains required to confirm a bearish divergence in momentum of a scale sufficient to break the major bull trend. Once the market breaks above 29-Apr’s 7.57 high, we will be able to trail this larger-degree corrective low and key bull risk parameter to Mon’s 7.03 low.

Market sentiment/contrary opinion indicators remain at historically frothy levels that we’ve no doubt will eventually contribute to a peak/reversal environment that will be massive in scope. But with the secular bull trend still arguably well intact, a failure below at least 7.03 and preferably 6.31 remains required to render this technical element applicable. In lieu of such weakness, it is not.

These issues considered, a bullish policy and exposure remain advised for long-term commercial players with a failure below at least 7.03 and preferably 6.31 required to pare or neutralize exposure. Shorter-term traders whipsawed out of bullish exposure on 06-May are advised to re-establish bullish exposure ahead of further and possibly steep gains yet ahead, with a failure below 7.03 required to negate this call and warrant its cover. Preemptive and cautious bear hedges for producers are also advised to be neutralized.

JUL CORN

Until and unless nullified by a relapse below Mon’s 7.69 low and new mini risk parameter, the technical construct for the Jul contract is the same as that detailed above in Dec following today’s recovery above last Thur afternoon’s 7.98 corrective high that renders the sell-off attempt from 29-Apr’s 8.25 high to that 7.69 low a 3-wave and thus corrective affair as labeled in the hourly chart above. That 8.25 high remains intact as a short-term risk parameter from which traders can objectively base non-bullish decisions, but to reinforce a broader peak/correction/reversal count, the market now has to weaken further below 7.69.

In sum, we believe the market has identified 8.25 and 7.69 as the key directional flexion points heading forward. Traders are advised to toggle directional biases and exposure around these levels commensurate with their personal risk profiles.