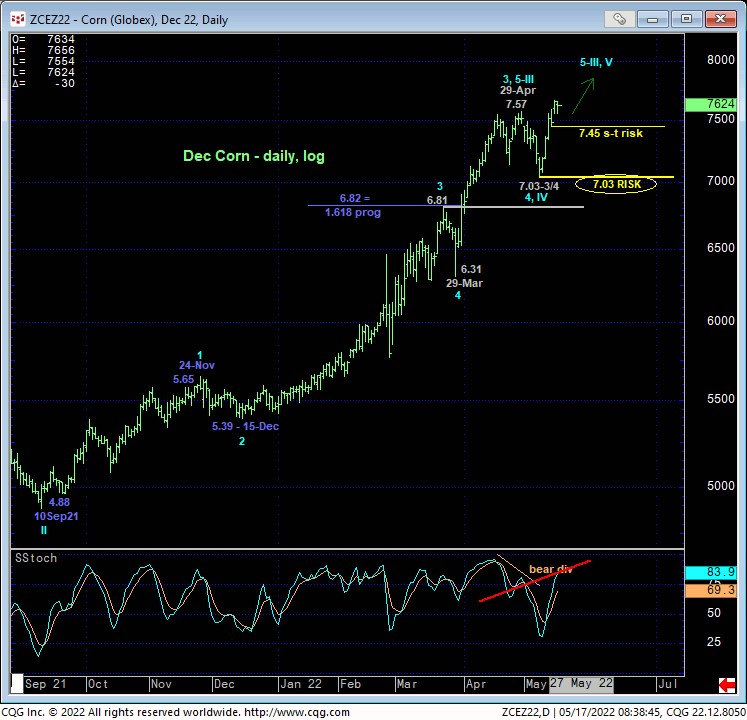

DEC CORN

Yesterday’s break above 29-Apr’s 7.57 high confirms our discussion in Thur’s Technical Blog following that day’s recovery above 05-May’s 7.39 high that rendered early-May’s sell-off attempt to 7.03 a 3-wave and thus corrective affair within the still-unfolding secular bull trend. This reaffirmation of strength leaves smaller- and larger-degree corrective lows in its wake at 7.45 and 7.03 that now serve as our new short- and long-term parameters from which the risk of a continued bullish policy and exposure can be objectively rebased and managed. Former 7.55/7.57-area resistance is expected to hold as new near-term support.

Only a glance at the daily (above) and weekly (below) log scale charts is needed to see that the secular bull trend in the Dec contract has resumed. The trend is up on all scales with NO levels of any technical merit above it, so further and possibly accelerated gains should not surprise straight away. The market’s upside potential is indeterminable and potentially extreme until and unless arrested by a confirmed bearish divergence in momentum, and this requires proof of weakness below at least 7.45 and preferably 7.03.

Market sentiment/contrary opinion levels remain historically extreme and typical of major PEAK/reversal-threat environments. But traders are reminded that sentiment is not an applicable technical tool in the absence of an accompanying confirmed bearish divergence in momentum. herein lies the importance of identifying corrective lows and risk parameters like 7.03.

These issues considered, a full and aggressive bullish policy and exposure remain advised with a failure below 7.45 required for shorter-term traders to step aside and commensurately large-degree weakness below 7.03 required for longer-term commercial players to follow suit. In lieu of such weakness, further and possibly accelerated gains are anticipated. Additionally, cautious producer bear hedges resulting from 09-May’s bearish divergence in short-term momentum have been nullified. We will wait for the next bearish divergence in momentum to resurrect a peak/correction/reversal threat for a preferred and objective risk/reward bear hedge opportunity.

JUL CORN

While the Jul contract has yet to recoup 29-Apr’s 8.25 high, yesterday’s recovery above 05-May’s 7.98 corrective high stems early-May’s sell-off attempt at 09-May’s 7.69 low in what appears to be a 3-wave affair as labeled in the hourly chart below. Left unaltered by a relapse below 7.69, this 3-wave decline is considered another corrective/consolidative event that warns of a resumption of the major bull trend that preceded it. Per such, this 7.69 low serves as our new mini risk parameter from which shorter-term traders can objectively rebase and manage the risk of non-bearish decisions like short-covers and resumed bullish punts. As 29-Ar’s 8.25 high has yet to be eclipsed, we have to still acknowledge it as a short-term risk parameter from which non-bullish decisions can still be objectively based and managed.

On a broader scale, while the market has yet to nullify 06-May’s bearish divergence in daily momentum, the 3-wave and thus corrective structure of early-May’s sell-off attempt and Fibonacci fact that this setback held the minimum (7.73) 38.2% retrace of the suspected 3rd-Wave rally from 29-Mar’s 7.10 low to 27-Apr’s 8.15 high on a daily log close-only basis would seem to reinforce the odds that the late-Apr/early-May setback is another mere correction within the secular bull market. To threaten this call, the market must first fail below 09-May’s 7.69 low and mini risk parameter. And even then, commensurately larger-degree weakness below former 7.45-area resistance-turned-support would be required to truly threaten the secular bull trend.

These issues considered and while a recovery above 8.25 remains required to, in fact, reinstate the secular bull trend, shorter-term traders are advised to return to a bullish policy and first approach setback attempts to the 7.95-area OB as corrective buying opportunities with a failure below 7.69 required to negate this call and warrant its cover. Shorter-term traders remain OK to maintain a neutral-to-cautiously-bearish stance as a result of 06-May’s bearish divergence in short-term momentum, with a recovery above 8.25 negating this call and reinstating the secular bull that would require moving to at least a cautious bullish policy. Long-term commercial players remain advised to maintain a bullish policy and exposure with a failure below 7.69 required to pare exposure to more conservative levels and commensurately larger-degree weakness below 7.45 to neutralize remaining exposure altogether ahead of a move to a cautious bearish stance.