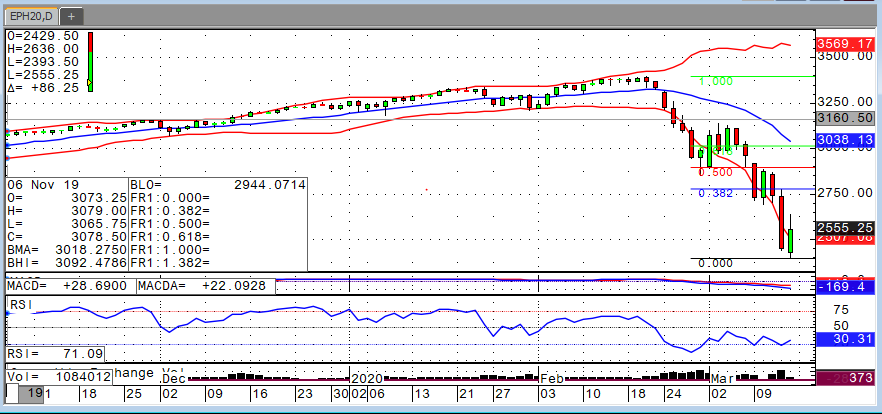

U.S. stock markets are having their worst week since the 2008 financial crisis. Thursday’s avalanche marks the largest one-day sell-off since 1987. In short, markets are in turmoil due to fears that the coronavirus threat will worsen, and economic activity will grind to a halt. This has been an evolving problem globally, but the effects are being firmly felt in America this week. Schools are closing, and large events are being cancelled as the virus multiplies every day. March S&P futures went limit up Friday morning before selling off again. It looks like more downside is in order as we head into the St. Patrick’s Day weekend. The chances that this virus will simply stop spreading over the next couple of weeks is next to nothing. Certainly, things will get worse before they get better as the market panic would imply. For the long-term investor, this will provide opportunity. But for the bottom-picker, this has provided only pain. Recovery rallies have been unable to hold. Friday morning, the Dow Jones is 26% off its all-time high last month. Testing the 38.2% Fib retracement level would only put the S&P back to Thursday’s high. The takeaway this week – just because it’s cheap doesn’t mean it’s a buy… tread carefully.