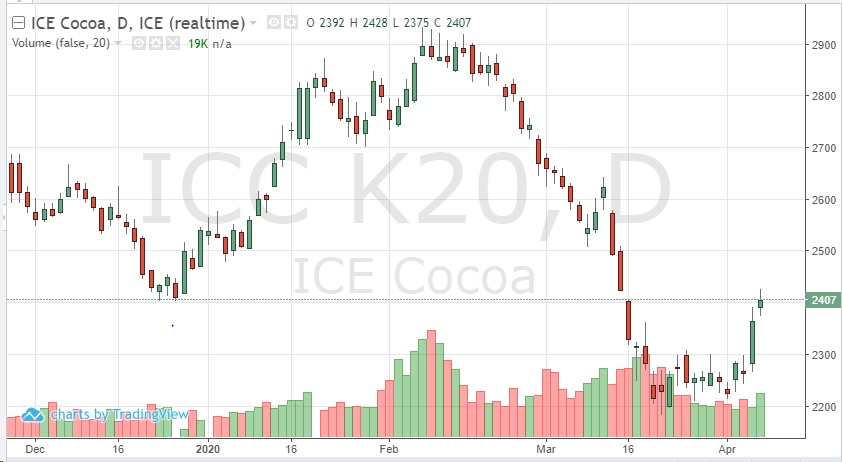

Although the May cocoa contract appears to have made the turn higher, it may be short-lived. After a few weeks of consolidation during the recent volatility, the May futures contract has turned higher trading above 2400. This move has followed a positive turn in the equities market. As the world continues to brace for more Coronavirus cases, the market feels as if small positive signs may be headed our way. Although no one knows how long these recent changes to everyone’s lifestyle will last, the health industry and government continue to make efforts to work together and make life safer again. Although we are far away from being “normal” again, small steps are needed to get there.

Cocoa does not have its own demand to help this move have any follow-through. There are many changes to deliveries and ports are closed causing the supply chain to be affected. Until there is more known about this virus, the softs and food markets will be trading off day to day news and updates.

Continue to monitor the market closely, if any breaking macro news occurs, it could send cocoa futures in either direction. But technically, the chart is showing traders cocoa wants to break out to the short-term highs we saw just a month ago.