With the G20 trade last weekend providing some possible relief in China/U.S. trade tariff war and a 90-day halt to any additional tariffs, the U.S. equity markets have had a rough week. U.S. payrolls came out this morning at 155,000 versus 198,000 expected, showing a possible fear that growth is slowing. Also in news, the U.S. Federal Reserve are showing a “wait and see“ attitude in regard to interest rates, which in turn is weighing on the dollar. This uncertainty in the dollar and U.S. equities has boded well for silver and other metals in the past week.

With that being said, can silver see the $15.00 area? While gold has been outperforming the silver contract for quite some time now and at the higher end of its range touches around $1250 an ounce, silver has been quite lackluster clocking in around the $14.50 area. While this has been the trend this year, if you look at silver for a cheaper product to invest in, this may be the answer. With rising global industrial and manufacturing production forecasts in 2019, we remain optimistic but cautious in the short-term. We think in the short-term silver will continue to be a buy toward the $15 level where it should run into quite a bit of resistance and will take a step back to see what happens on a macroeconomic scale in the next few months and wait to see how things play out. It may be a great time to look at some excellent options strategies that exist given the above outlook and with our thoughts prices will remain between $14.00 and $15.00 with a slightly bullish sentiment.

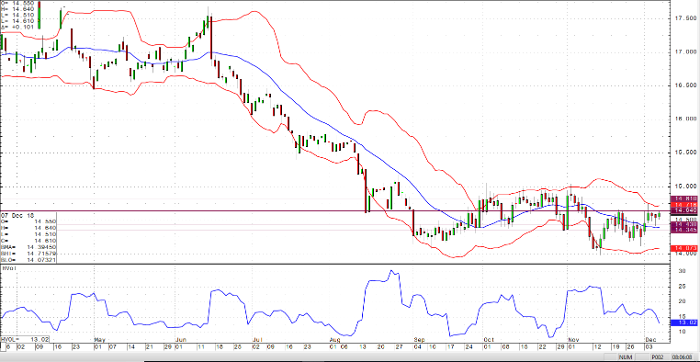

Support: $14.43/$14.35

Resistance: $14.64/$14.81

Silver Mar ’19 Daily Chart