As of Thursday, the June 2019 Crude oil futures and options contracts are being offered as the market is down over approximately 2 dollars. This week, and yesterday especially, a number of developments seem to have shifted from bull to bear control of the market. Some of the main developments so far have been:

-The weekly EIA report showing a build of 9.9 million barrels

– The FOMC announcement and following press conference noting a lack of inflation

– A lack of added tension from the end of Iranian waivers

Also noteworthy is the bearish market action amid the tensions in Venezuela and announcements of OPEC+ cuts planning to be extended.

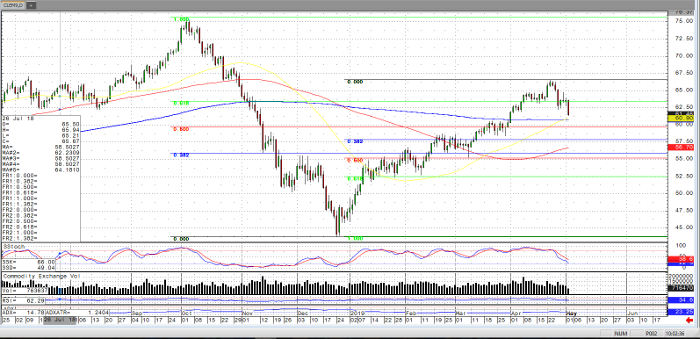

Given yesterday’s non-dovish, possibly hawkish by default FOMC and corresponding strength in the Dollar, it is not out of the question for the market to trade to the 38.2-50% area pictured below, for both the recent months low to high and high to low moves, along with the amount of longs in recent COT reports. It is also possible for the averages pictured below to offer some support or resistance should the markets follow through.

Crude Oil Jun ’19 Daily Chart