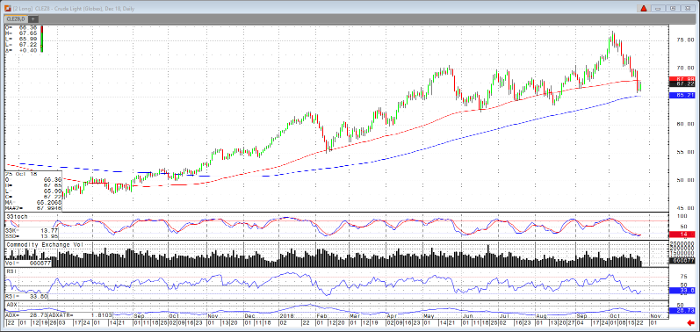

As of Thursday afternoon, the December crude oil contract is trading around the $67.40 per barrel level, up minimally today while still inside the range of the down day two days ago. The market is also inside the range bound by the 100 DMA and 200 DMA (daily moving averages). While the 200 daily moving average has acted as support to this point, the breach of the 100 day moving average could be a precursor to further declines below, switching the 200 day moving average from support to resistance, similar to the $71 price level noted 2 weeks ago.

As mentioned to Reuters previously, this comes at a time of year when refineries typically are in turnaround, as seen in recent EIA reports including builds in inventories and refinery utilization rates at levels lower than those in weeks past. Outside markets have also featured drawdowns in equity indices and may translate to decreased energy demand, along with a safe haven bid in the dollar, which has traded at the year’s high today.

It is also noteworthy, and visible on the chart below, that today’s trading comes on lighter volume and with ADX, RSI and Stochastics at low levels. Traders unsure of the market’s reaction to the moving averages may want to position with an options strategy.

Crude Light Dec ’18 Daily Chart