As of Thursday afternoon’s trading, the April contract of WTI Crude traded $65.74 per barrel as the market was strong and quite different from the first half of the week. As the market looks to re-test recent tops in the low $66 per barrel range, it is interesting to see the third test of this level which some would say formed a double top from late last week to early this week.

As the market traded accordingly below the base of this double top, this also coincided with the anticipation of the State of the Union, Fed decision and the first EIA inventory build in nearly three months. While a build in inventories is fundamentally bearish, draws in inventories in product markets such as gasoline and distillates. There have also been reports concerning the global demand and supply stories for oil. RJO Market Insights via Hightower note the following:

- US crude oil output surpassed 10 million barrel per day level for the first time since 1970

- China’s independent refineries increased imports by 40% on a year-over-year basis last year

- Japanese Saudi imports hit 35 year highs

- Dubai April cargoes were completely sold out for delivery to Asia

While there are still healthy longs in the Commitment of Traders and record US production, it will be interesting to see if recent highs remain recent highs or become new support, such as the $64 per barrel level since the 16th of this month. Failures here could lead to a re-test of this level.

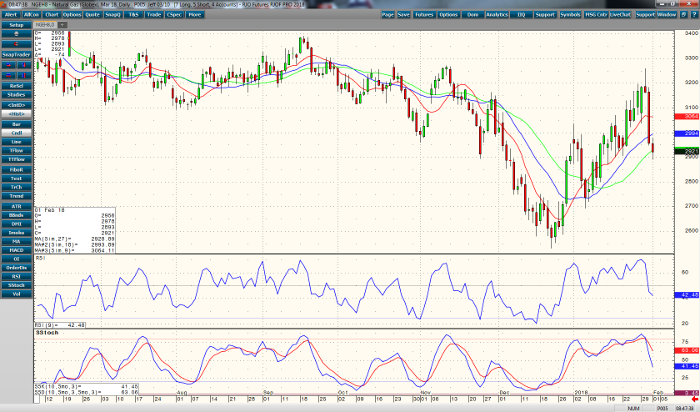

Crude Oil Apr ’18 240min Chart