While many risks remain in crude one of the main macroeconomic fears moving forward towards a price recovery will be an early increase in production before demand is fully restored. The next OPEC+ meeting is just a couple weeks away, where members will discuss its production policy going forward. The group will need to add to existing cuts to production and cities will need to continue easing restrictions in order to see continued bullish conditions. Stockpiles for the U.S. were down 745,000 barrels and the EIA is now forecasting U.S. output to decline to 540,000 bpd. Futures traders have moved positions into further out months in order to stay safely away from any sort of volatility that we saw so extremely before.

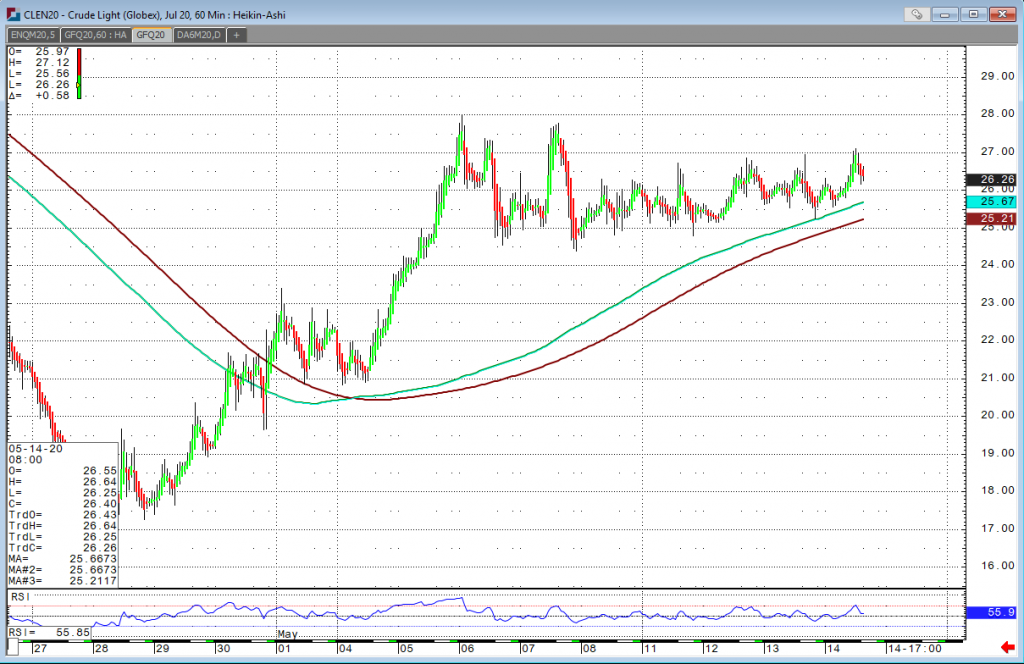

Looking at July crude we see what could be a positive signal for a short-term move. Support showing on the one hour chart at $26.00. We can see that if this level of support breaks a move to $25.21 level can happen quickly. July crude resistance starts at $26.50, which will need to brake in order to potentially see a test of $27.00 resistance. The next upside target remains at $27.50 on the contract.