The August crude oil contract has had a strong week opening at $57.77 and is trading at $60.28 per barrel. Wednesday’s EIA had a much stronger than anticipated draw in inventories of 9.5 million barrels along with stronger equities and a risk on tilt this week.

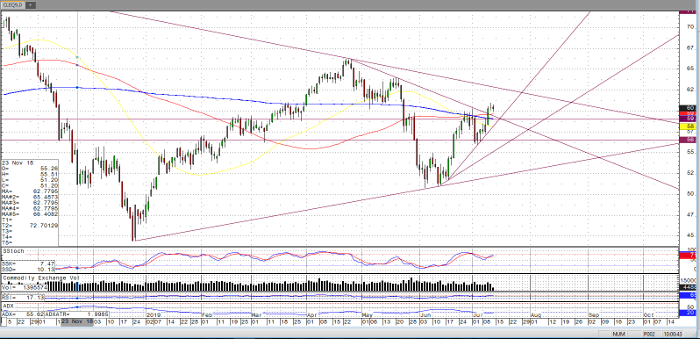

As the market is now above the $60 per barrel level, it will be of interest to see if the market is able to sustain this level as yesterday’s candle has the potential to be an island reversal should today continue to trade lower than yesterday’s close. The chart below also shows a trendline break to the upside, potentially leading the way for a re-test of the highs of April this year.

While the technical action this week has taken the market above a number moving averages, and it could be possible to see some chop around the $60 per barrel level, akin to late March. The market should be facing a trend decision regarding the $60 level as well as the typical supply and demand factors.

Crude Oil Aug ’19 Daily Chart