U.S. crude rose 1.4 million barrels to a record high according to EIA data. Demand will eventually play a key role in balancing the markets, the increasing COVID case count in areas that opened early suggest the added pressure in WTI. It should be noted that although global markets teeter on the brink of risk aversion connected with the outbreak of the new Covid-19 disease in the United States, oil fundamentals overall are still moving in the right direction, towards recovery and increased refining in global oil refineries. Global supply decreased by nearly 12.2mn barrels per day in the month of June, on an annual basis, due to nearly 9.1mn barrels per day of OPEC+ cuts. Traders will be watching whether China will continue to import at the same pace as we saw in May, as well as waiting to see if OPEC will hold discipline and extend their cut past July.

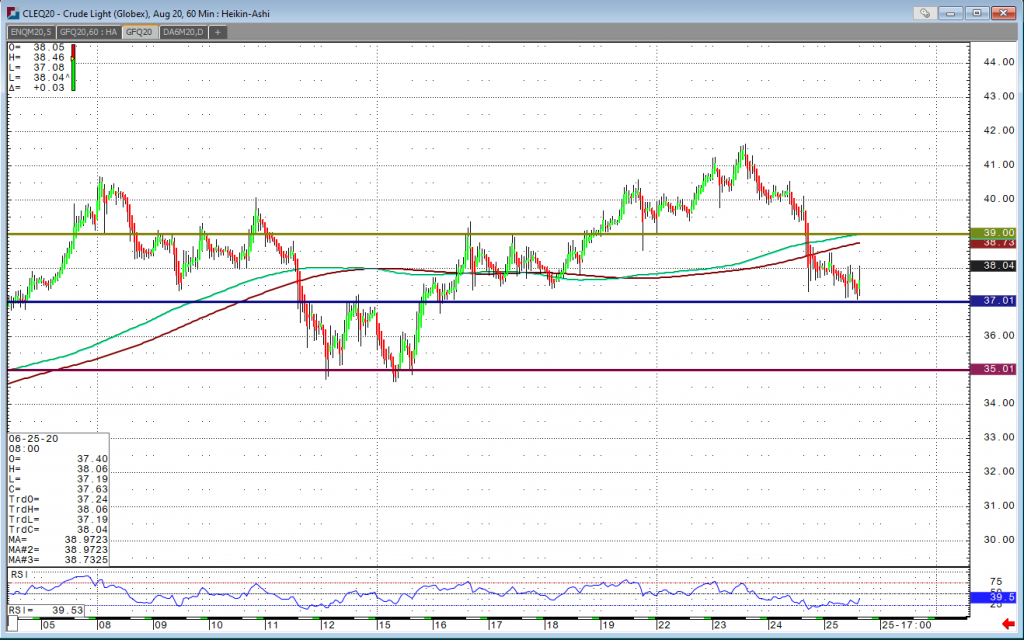

Momentum studies have started to turn negative, and are trending lower from previous overbought levels. August crude has support at $37.00 and a break of this should see a move to the next level of support at $36.50. If we see these levels hold the technicals point to resistance at $38.00 and should we see this level break we should see a test of resistance at $38.70.