Crude oil futures have rallied over 41% year to date and with oil supplies continuing to tighten it would not surprise me to see $70 by year end. There has been a fundamental shift with the U.S. not renewing waivers that allow countries to buy Iranian oil without facing sanctions. This could be met with retaliation from Iran which threatened to close the Straits of Hormuz. Looking at the inventory data, current supplies are sitting at 460 million barrels while the 5-year average is 458 million barrels. There was a small pickup in imports which helped offset some of the tightness. Something to watch is the national average for gasoline that is sitting at $2.836 per gallons and is an increase of 30 cents over the past month.

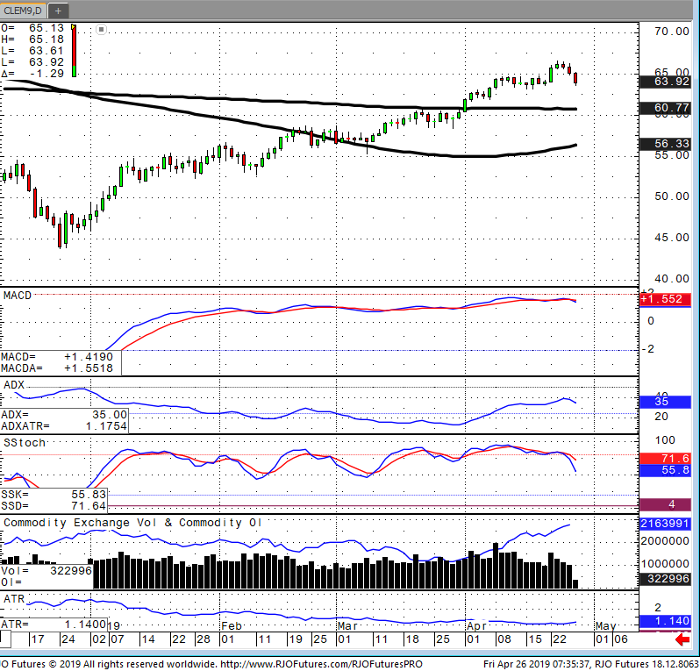

Crude Oil Jun ’19 Daily Chart