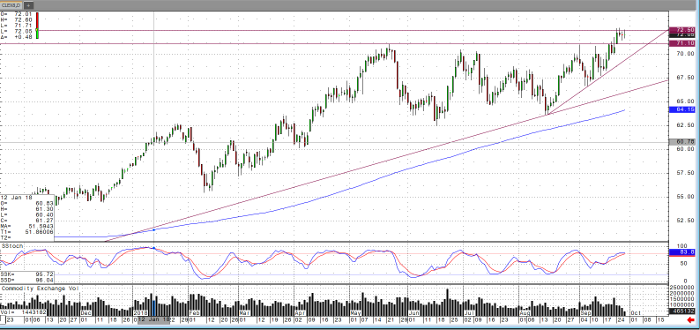

As of Thursday morning, the crude oil market has been interesting to watch as the market remains in an uptrend over the long term. The recent day’s downward price action has occurred with a build in inventories and a significant drop in the refinery operating rate and lower volume in the November contract.

While the market has traded above highs of the year recently, at around $72.00 per barrel, it has since stalled ahead of possible continuation of the longer-term bull trend or an overbought reversal. Should the market continue to resist trade above the $72.50 level, it will be interesting to see if the previous highs act as support. Furthermore, it may be noted that the bear side of the market has had little in terms of consecutive days downward since early in the month.

Along with the build in inventories and lower refinery capacity rate, there are numerous factors such as: supply from OPEC, the US Special Reserve, upcoming Iran sanctions, and how effective they will be; not to mention demand and inflation from strong stock markets and a number of reflationary elements at work.

Crude Oil Nov ’18 Daily Chart