As of Thursday morning, the front month May 2019 Crude Oil contract is trading above the $60 per barrel price following yesterday’s fundamentally significant surprise drop in crude inventories coupled with inventory declines in gasoline and distillates and a dovish Fed announcement which removed the 2 hikes in the Fed dot plot for this year. Considering:

- the majority of estimates were looking for a slight build in inventories before the 9.6 million barrel draw and,

- for some, the Fed may have been more dovish than expected (i.e. one rate hike removed from the dot plot as opposed to both for 2019

the market has reacted bullishly from supply fundamentals and the inherent interest rate differentials in for the U.S. dollar.

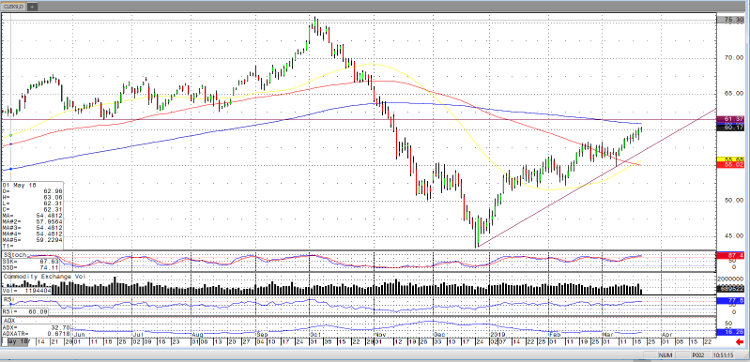

While these fundamental factors are priced in and evident in trading since yesterday, today the market is seesawing around the $60 per barrel level and moving forward it would seem there are other factors to be considered. Today for instance, the USD is stronger compared to other major currencies especially considering the upcoming Brexit outcomes. Also, the market seems tethered to the $60 level for the time being and the 200-day moving average and $61.37 level pictured below seem to be offering resistance in addition to the psychological $60 level.

Traders may also note the dovish policy decisions and their basis in addition to the possibility of oil becoming its own worst enemy and adding to inflation and stifling growth should the market continue to make new highs for the year.

Crude Oil May ’19 Daily Chart