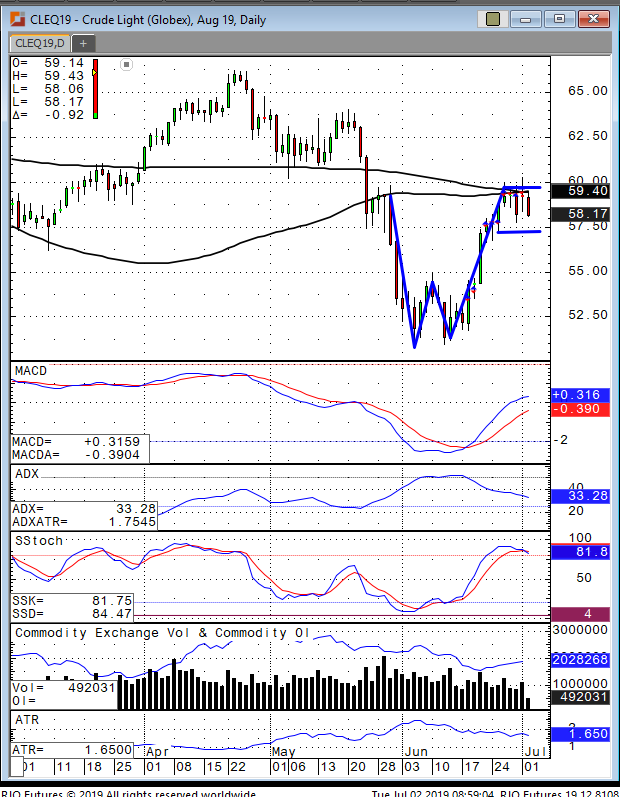

Crude oil futures have completed the latest double bottom pattern and is now creating a rising wedge pattern leaving $60.28 as a breakout point on the chart. With OPEC extending cuts for another 9 months, this leaves the market open to a contraction in current supply versus the five-year average if the driving season picks up. The red flag is a close below $57.20 where we could see a quick break back down to $55.00. This could happen on the lighter volume into the holiday market and slumping economic data leaving the market more of a coin flip at this point. Continue to watch the technicals and enjoy your holiday.

Crude Oil August ’19 Daily Chart