As of Thursday, the July crude oil contract is trading on the lows of the day in the $58 area. This comes on a morning featuring delayed energy reports due to the Memorial Day Holiday Monday as the July contract yesterday traded down to $56.88, the lowest level since March 8th of this year.

As I noted last week, the market has continued to test the $57.50 level, having probed lower yesterday and trading lower so far today amid a smaller than expected draw in inventories of -0.3 million barrels. In addition to yesterday’s API numbers and today’s EIA number, there are conflicting factors with several bearish developments from outside markets recently and possible increased geopolitical tensions which could disrupt supply in the Middle East.

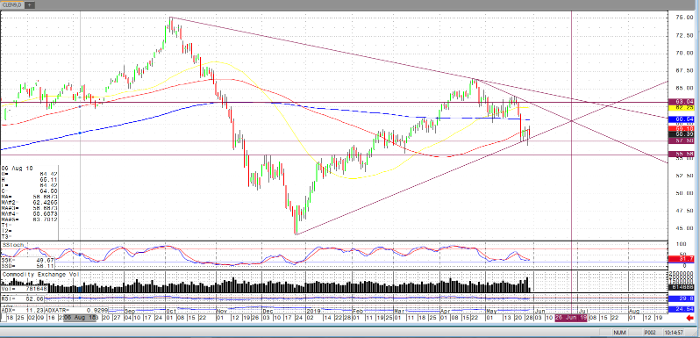

Consider the levels on the chart below in addition to the EIA reaction and developments in outside markets. As the API yesterday showed a larger than expected draw and this morning’s EIA a smaller than expected draw. Also, of note, gasoline with a build of 2.2 million barrels and distillates with a draw of 1.6 million barrels.

Crude Oil Jul ’19 Daily Chart