As of Thursday, the April 2019 crude oil contract is being offered as the market weighs a build in this morning’s EIA number, a stronger dollar and downward price action typical with risk off sentiment in equites, metals, softs and interest rate products. Also of note, as crude had a built in inventories, the gasoline and distillate inventories had a draw. While the March crack spread closed yesterday at 9.32, the April crack spread is trading around 17.18 as of this writing and has rebounded almost 50% from January 31st’s 12.10 low.

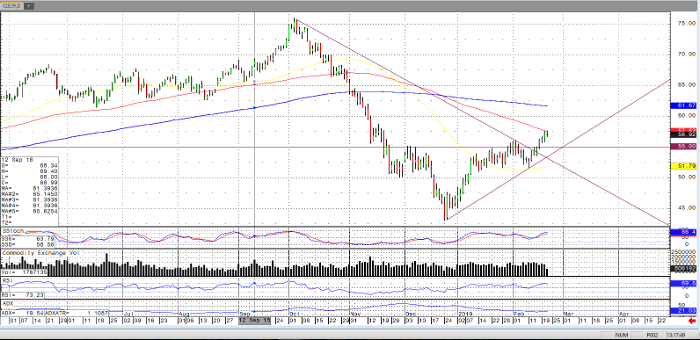

Visible in the chart below, today’s high tested the 100-day simple moving average for the second consecutive day as the market has cleared the $55 per barrel level, for now. In other relevant news, CFTC commitments of traders, which were delayed due to the government shutdown, have shown increases in longs. For the time being, it seems that 100-day moving average should be a significant indicator as the market has treated this level as resistance, in recent days, for now at least.

While today’s price action, at the time of this writing, has been an inside day, it would seem possible for the market to give back some of its recent strength as today could be the first down day in the contract in weeks. Equally possible, should the 100-day simple moving average be traded through with continued strength, the market could continue to trade at price levels not seen since last autumn.

Crude Oil Apr ’19 Daily Chart

If you would like to learn more about energy futures, please check out our free Fundamental of Energy Futures Guide.