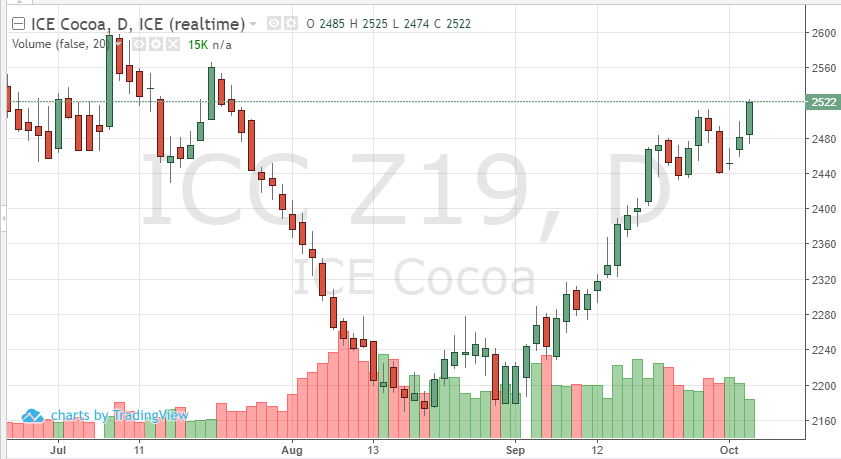

Looking at the December cocoa chart, there are two stories being told – a supply and demand battle, and technical levels guiding prices. After the big sell-off from July to August the market erased that turn lower and now has cocoa testing a key resistance point, 2525. This mark has held a few times without ever allowing a large move higher. If the perfect equation can come together – technical data, global risk/currency trade and supply/demand, prices may be able to trade and hold above 2600.

Currently, West Africa supply data is weak, helping support prices but the demand is not there for the soft. Europe and North American demand continues to be weak, somehow Asian demand has been able to brush off the ongoing trade issues. The Euro and Pound, as well as weakness in the stock market, continue to add volatility to cocoa. The Dow and S & P have dropped this week, as low as the levels we saw in August, but a recovery appears to be forming. Look at all these outside factors as little pieces that could give us short-term guidance in cocoa. A boost in demand is the key for the December contract to move hold above 2600 before contract expiration.