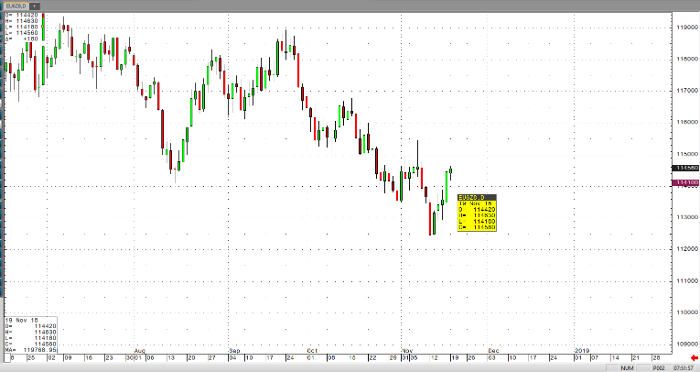

A failed break of the bullish continuation pennant has precipitated a quick violation of the 11516 level, and subsequent sell-off to the 11100 area. This should be viewed as a bearish signal, and although December coffee prices were able to hold good support over the past week, we still see formidable resistance at the 200-day moving average of 12142.

A slower harvest in Vietnam, along with a currently weak USD and inverse strength of the Brazilian currency may prompt rallies to the 200-day moving average, but from a short term perspective, it looks like December coffee prices will be into good resistance at the aforementioned 200-day moving average.

Coffee Dec ’18 Daily Chart