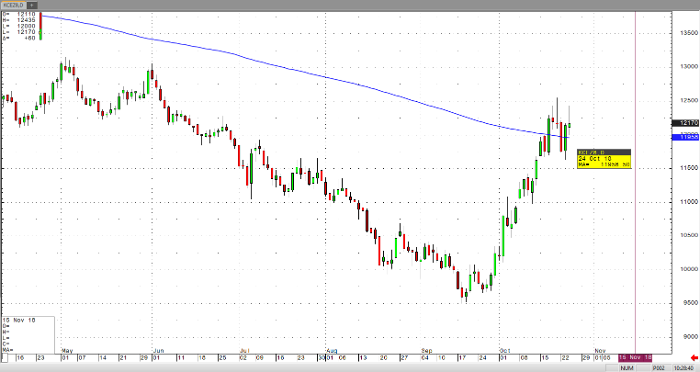

It appears as if the bullish forces are still in charge of coffee prices, continuing the momentum that’s been in place over the past month. The continued strength in December coffee prices continues to be a straight-forward tight supply outlook for 2019/20. What may have started as a significant short-covering rally, has now turned into a bullish long-term supply/ demand outlook, which looks like a solid reversal to the upside in December coffee prices. Bullish traders should consider initiating new long positions on corrective pullbacks.

On the technical side, a rally, temporary consolidation, and ultimate break above the 200-day moving average (and subsequent close above) was in fact bullish, and triggers technical buy signals for traders. Consider using put options to take a bearish position and manage risk effectively.

Coffee Dec ’18 Daily Chart