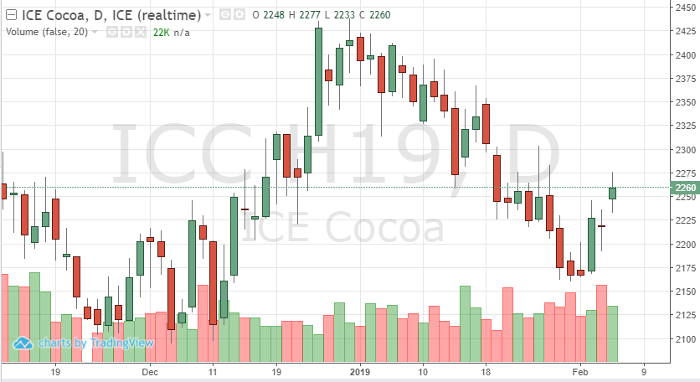

Bulls in the cocoa futures market have waited patiently for the demand of the soft to improve. Over the past few sessions, the patience has paid off. Longs have re-established their positions as funds have also increased purchases. Production levels have been able to cancel demand increases in the past though as they have washed each other out. The market has quickly gone from oversold, to a buying opportunity. Currencies must be monitored, as the dollar has gained strength while the euro and pound have weakened. COT reports have shown increases in the longs, if traders continue to believe prices should be higher look for this continued path. Global markets are still a concern and key factor adding to volatility across all commodities. As we approach the March roll in the futures, traders will monitor if longs re-establish in the May contract. With resistance broken at 2255, look to see if the market can move and close above 2285. In a market that many traders believe should be trading near 2400, watch to see if supply/demand is enough to support those levels.

If you would like to learn more about softs futures, please check out our free Fundamentals of Softs Futures Guide.

Cocoa Mar ’19 Daily Chart