Global equity markets were mixed overnight with Asian markets generally positive and European markets generally weaker. In a slightly disappointing development for the bull camp, the market remains lower this morning in the face of better than expected quarterly profits/revenues from PepsiCo. News that Seattle passed an income tax on high earners is potentially a major negative as that signals a fresh revenue angle for other cities and that news adds to the threat of higher Illinois income tax rates from last week. In short, instead of seeing the realization of federal tax cuts/reform and infrastructure spending, US stock markets continue to see regional tax drags on growth. With Pepsi beating revenue estimates, the market starts the Tuesday trade with a specific positive fundamental news item. Unfortunately, initial US price action in the E mini S&P failed to follow Asian stocks higher and the E-Mini appears to have critical pivot point just under the market at 2419. An issue that might favor the bear camp early today is the fact that defensive shares pulled down European markets and there also appears to be some weakness in oil sector shares early today. A more significant consolidation support zone is seen at 2415.

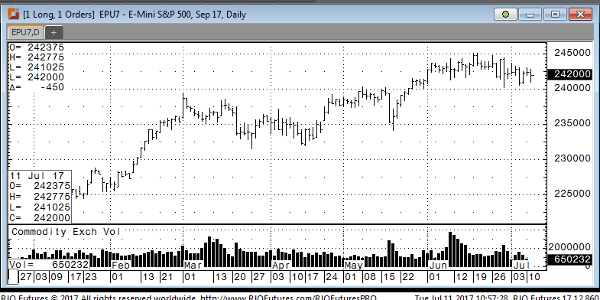

Sep ’17 E-mini S&P 500 Daily Chart