Last month’s COF report was considered neutral to supportive. The higher slaughter reflects current feedlots and higher placements reflect the discount past April futures. The product market continues to show strength and packers have enough margin to bid up the fed cattle. That being said the charts still have room to fill in to the downside but may not till April goes off the board.

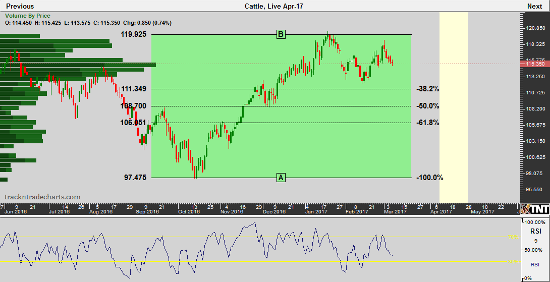

I mentioned last blog that selling options in this market may be a good way to gain exposure in a trade with a strong case for both sides between 108-132 in the front-month live cattle futures. The largest volume accumulation over the past 6 years has been between 116-120 on a continuation chart. If April washes out longs slightly, we’ll probably see 112 with value support at 110. A larger washout would test 107.50 area which is an area Elliott Wave analysts are discussing. Weekly and monthly washouts in front month go as low as 104-105 area in front month live cattle futures. If you are new to futures’ options consult your broker for risk considerations.

COT reports show a positive but not bearish net long in the non-commercials and this Friday’s update may take some of that off the board since last Tuesday was the highest close since the end of January as Feb 17’ went off the board (but likely not much).

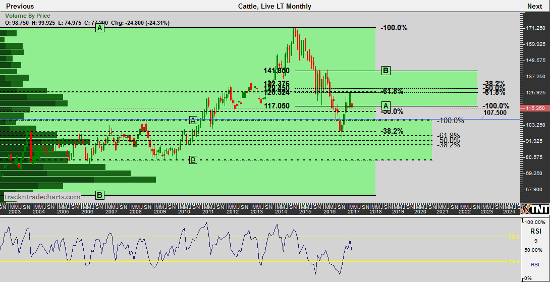

Deferred live cattle futures may still be cheap considering the strong product market as the retail end seems to be buying some of the demand back. Good weather and animal instincts should contribute to more steaks on the grill this Spring.

Live Cattle April 2017 Daily

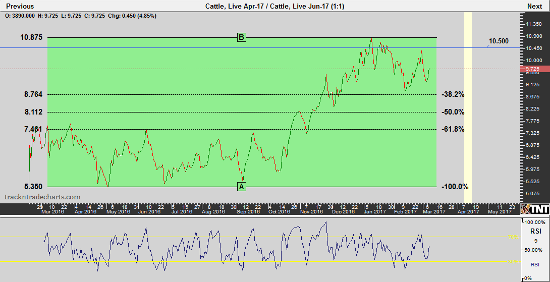

Live Cattle – April over June Spread

Live Cattle Monthly Continuation

Source: Track’nTrade